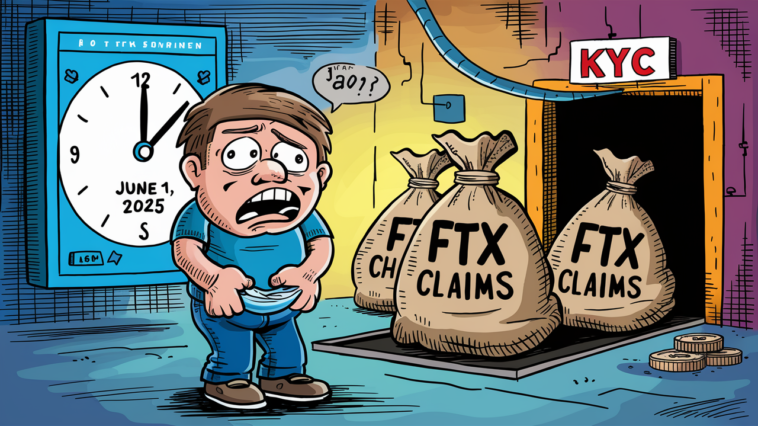

400,000 FTX Users Might Miss Out on $2.5 Billion — Oops

The Clock’s Ticking on KYC

Nearly 400,000 people using FTX might lose out on $2.5 billion. Why? Because they haven’t verified their identity through KYC.* It’s like showing up to claim a prize but forgetting your ID.

*(KYC = “Know Your Customer,” a fancy way to say you need to prove who you are.)

The court says these users had until March 3, 2025, to get it done. That deadline passed faster than your New Year’s resolution. But good news — it’s been extended. Now you’ve got until June 1, 2025. Mark your calendar.

Here’s What Happens If You Don’t

If users don’t complete KYC by the new date, their claims vanish. Like poof. Gone.

Smaller claims (under $50,000) add up to $655 million. Bigger ones? About $1.9 billion. That’s a whole lot of money floating in limbo.

All that cash will be disqualified unless users act fast. It’s like watching someone walk away from a winning lottery ticket.

The Next Payday is Coming

The next round of repayments is set for May 30, 2025. Over $11 billion is on the line.

FTX’s plan promises that 98% of creditors will get at least 118% of what they lost — in cash. Yes, more than they originally had. That’s rare in bankruptcy land.

Trouble in the KYC Process?

Some users say the KYC system has been a bit… glitchy. That’s not shocking.

If you had trouble before, don’t panic. You can try again. A user named Sunil (he’s part of the creditor committee) says you should email FTX support for help.

Step-by-step: Email FTX. Get a ticket. Log into the portal. Upload your stuff again.

Sounds annoying. But missing out on your crypto refund? Way worse.

FTX’s First Payout Already Happened

FTX Digital Markets, the Bahamas-based arm of the company, started paying people back in February. They handed out $1.2 billion in the first wave.

So yes, the money is real, and it’s moving.

The FTX Collapse Still Haunts Crypto

Let’s not forget: FTX crashed hard. Over 130 companies connected to it went under. Bitcoin dropped to around $16,000 during the mess.

But now? Things are finally looking up. These repayments show crypto might be growing up a bit. Slowly.

Bitget Wallet’s COO, Alvin Kan, says this won’t shake the market, but it’s a good sign. Some of that cash might find its way back into crypto.

We’ll see.