Recently, Binance co-founder Yi He addressed rumors around the exchange’s process for listing new tokens. He mentioned that 98% of listing applications actually go unanswered. This clarification followed a claim from Moonrock Capital’s CEO, who said Binance required 15% of a project’s token supply in exchange for a listing.

Transparent Fees, Not Token Demands

Yi He denied Moonrock’s allegations, explaining that Binance doesn’t ask for tokens or charge a set fee for listings. Since 2018, Binance has allowed project teams to suggest a donation amount, which is then given to charity. The company’s policy is fully transparent, and there’s no minimum donation required.

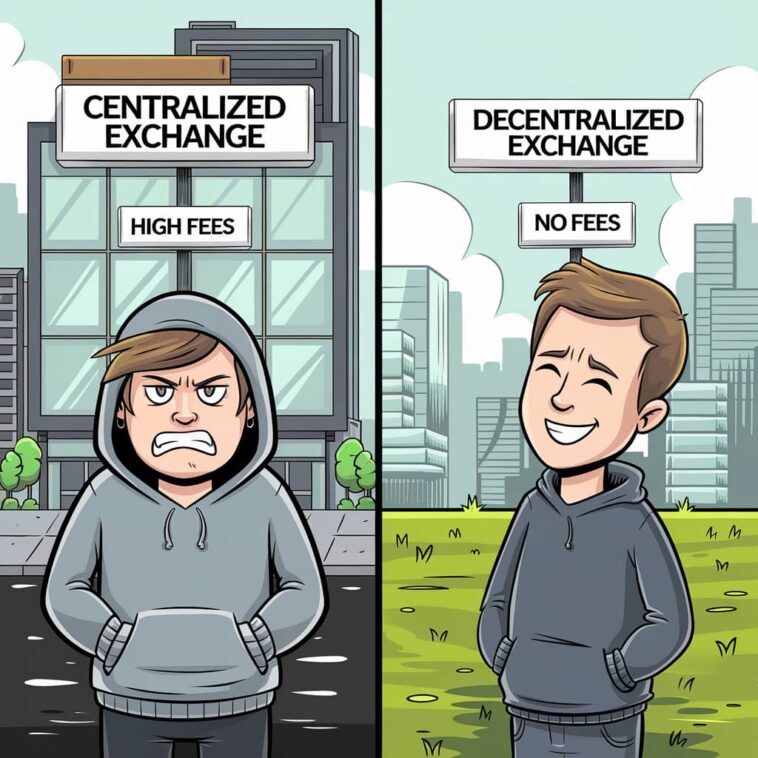

Growing Frustration With Centralized Exchange Fees

Moonrock’s claims sparked a wider conversation about high fees on centralized exchanges, with Andre Cronje from Sonic raising similar issues about Coinbase. Many in the crypto space see these fees as roadblocks that make it harder for new projects to list their tokens.

Centralized Exchanges Face Volume Drops

Meanwhile, trading volume on centralized exchanges has been slipping. In September 2024, exchanges like Binance, OKX, and Kraken saw volumes drop by 20-30%, likely due to global tensions, the upcoming U.S. elections, and an increasing shift to decentralized exchanges.

Backlash Over Binance’s Listing of Scroll

On October 11, Binance announced the listing of Scroll, a layer-2 solution aimed at making Ethereum transactions faster and cheaper. Some in the crypto community felt this move went against Scroll’s decentralized values. In response, a user named Zeng Jiajun called out the high fees that centralized exchanges demand, asking people to imagine Ethereum’s Vitalik Buterin paying a hefty percentage just to list Ether.