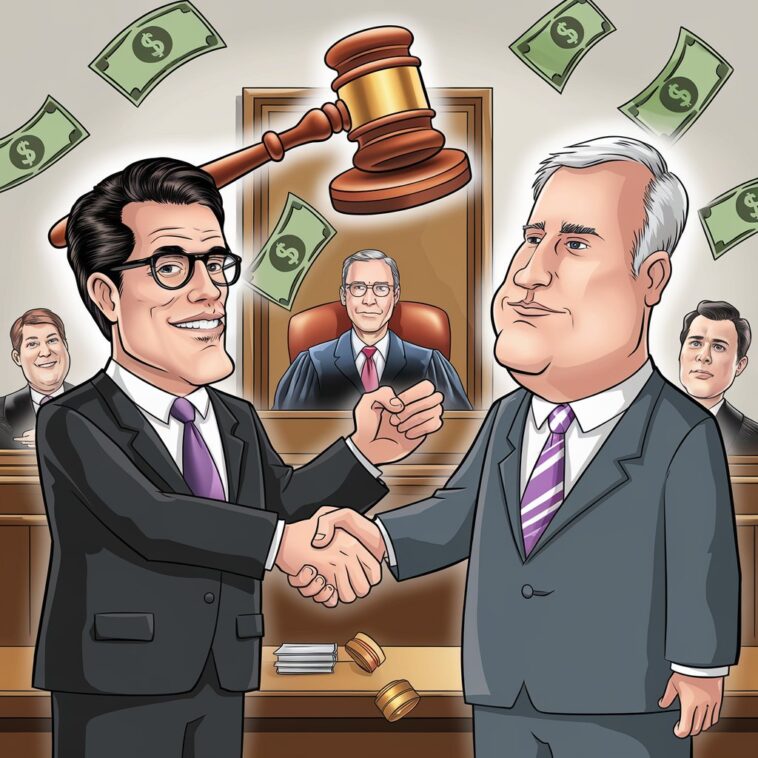

FTX is taking legal action against Anthony Scaramucci’s company, SkyBridge Capital, seeking to recover over $100 million spent on deals with the firm before FTX collapsed in 2022. The money was spent by FTX’s former CEO, Sam Bankman-Fried, on sponsorships and investments that FTX lawyers say weren’t wise choices.

The Deals with SkyBridge

In 2022, Sam Bankman-Fried made several big moves with SkyBridge. FTX paid $12 million to sponsor the SALT conference in January, then invested $10 million in the SkyBridge Coin Fund through Alameda Research, FTX’s trading firm. Later that year, FTX bought a 30% stake in SkyBridge’s investment arm for $45 million. FTX lawyers claim this deal didn’t make sense because they could have purchased the same cryptocurrencies for less on their own.

Breach of Contract

FTX also claims SkyBridge violated their agreement by selling some of the digital assets—like Bitcoin and Solana—without asking for permission first. According to FTX, these assets, originally worth $60 million when sold, could now be worth $120 million.

FTX’s Ongoing Lawsuits

This is just one of several lawsuits FTX is pursuing to get back money. They’ve also taken legal action against other platforms, like KuCoin and Crypto.com, in an effort to recover frozen assets.