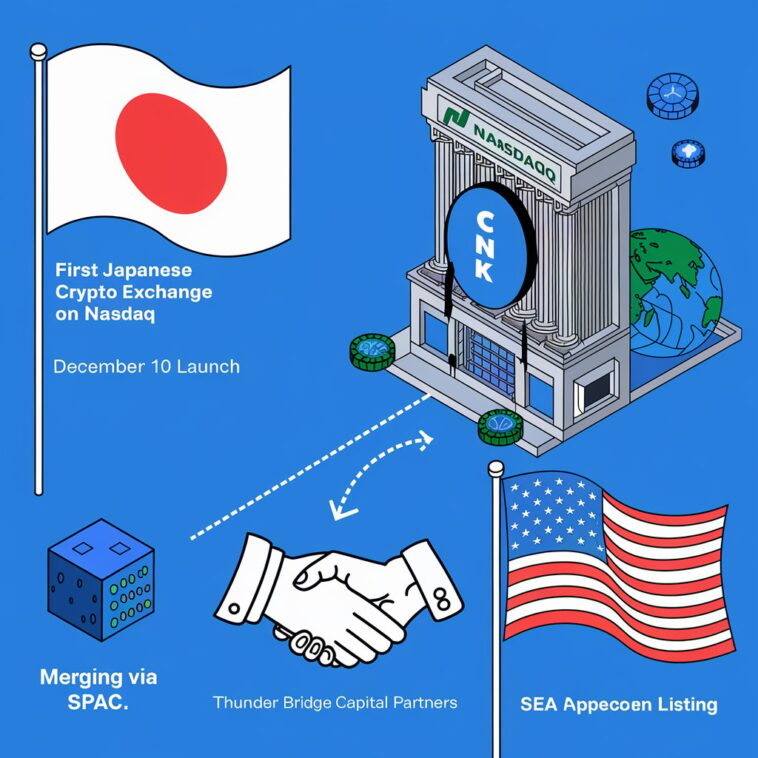

Coincheck, a cryptocurrency exchange based in Tokyo and part of Monex Group, has just gotten the green light from the U.S. SEC to list on Nasdaq. This move, planned for December 10, makes Coincheck the first Japanese exchange to join Nasdaq and could be a big step for Japan’s role in the U.S. crypto market. The listing will happen through a merger with Thunder Bridge Capital Partners (TBCP), a special acquisition company (SPAC)*.

Expanding Japanese Crypto’s Reach to the U.S.

With the SEC’s approval on November 13, Coincheck’s Nasdaq debut could inspire other Japanese exchanges to think about international listings. After the merger with TBCP, Coincheck will stay under Monex Group, setting a precedent for Japanese crypto’s presence in the U.S. market.

How the SEC Approval Happened

Coincheck began the listing process by filing a Form F-4 registration on November 7. The SEC gave the thumbs up on November 12, allowing TBCP to hold a shareholder vote on December 5 to finalize the merger. If shareholders approve, Coincheck will begin trading under the ticker symbol “CNCK” on December 10.

What This Means for the Crypto World

Coincheck’s listing could deepen ties between Japan and the U.S. in crypto, possibly encouraging other Japanese exchanges to go global. It may also attract more international crypto businesses to American markets, especially as the U.S. is expected to adopt a more pro-crypto stance under the new administration.

The SEC’s Influence on U.S. Crypto

The SEC’s cautious approach to crypto has shaped the industry, influencing how digital assets are handled in the U.S. But some crypto leaders, like ConsenSys CEO Joe Lubin, argue the agency is too restrictive. ConsenSys even issued an open letter urging the incoming U.S. administration to adopt friendlier crypto policies, reflecting a growing call for regulatory change.

*SPAC (Special Acquisition Company): A publicly traded shell company created to take private companies public by raising money through an IPO to merge with or acquire a company.