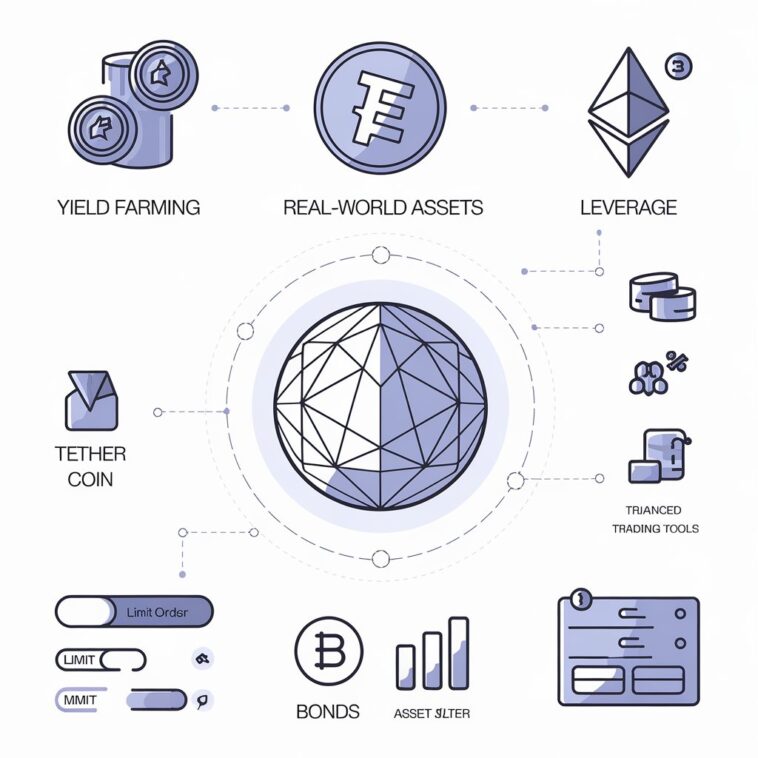

Primex Finance has rolled out new options for DeFi traders and yield farmers, letting users earn returns with more flexibility. These updates include leveraged yield farming,* access to real-world assets (RWAs), and advanced trading tools.

*Leveraged yield farming: Using borrowed funds to increase the potential returns from yield farming, though it can also increase risk.

Yield Farming with Leverage and Real-World Assets

Primex now lets users engage in yield farming with leverage, giving them a way to amplify returns by borrowing extra funds. It also opens up access to real-world assets through partners like Ondo and Paxos, so users can diversify beyond crypto into assets tied to traditional finance, such as bonds or commodities.

New Incentives for Lenders

To fuel these strategies, Primex is offering rewards to lenders who provide liquidity in Tether (USDT), USD Coin (USDC), and Ether (ETH). This initiative is designed to build a stronger asset pool, making it easier for traders and yield farmers to access funds.

Tools for Greater Control

Primex has added tools like limit orders and automated trading features, so users can set precise points to buy or sell without needing to constantly watch the market. These options combine the efficiency of centralized exchanges with the independence of DeFi, giving users more control and flexibility.

New Role on Primex: Farmers!

New Role on Primex: Farmers!  Farmers can now boost yield with leveraged farming on Primex! Borrow capital and use leverage to amplify returns from low-risk strategies without needing over-collateralization.

Farmers can now boost yield with leveraged farming on Primex! Borrow capital and use leverage to amplify returns from low-risk strategies without needing over-collateralization. Key strategies:

Key strategies: Borrow

Borrow