The crypto industry has faced growing challenges with debanking, especially during Operation Chokepoint 2.0. Jason Lau, Chief Innovation Officer at OKX, explained that fostering strong relationships with banks and regulators is essential to avoid these risks.

Trust in Traditional Finance

Lau emphasized that trust drives the financial sector. Crypto companies must work closely with banks, regulators, and stakeholders to ensure mutual understanding.

“We’ve spent years helping partners understand our business,” Lau said, highlighting the importance of long-term collaboration.

Global Impact of Debanking

Debanking isn’t just a U.S. issue:

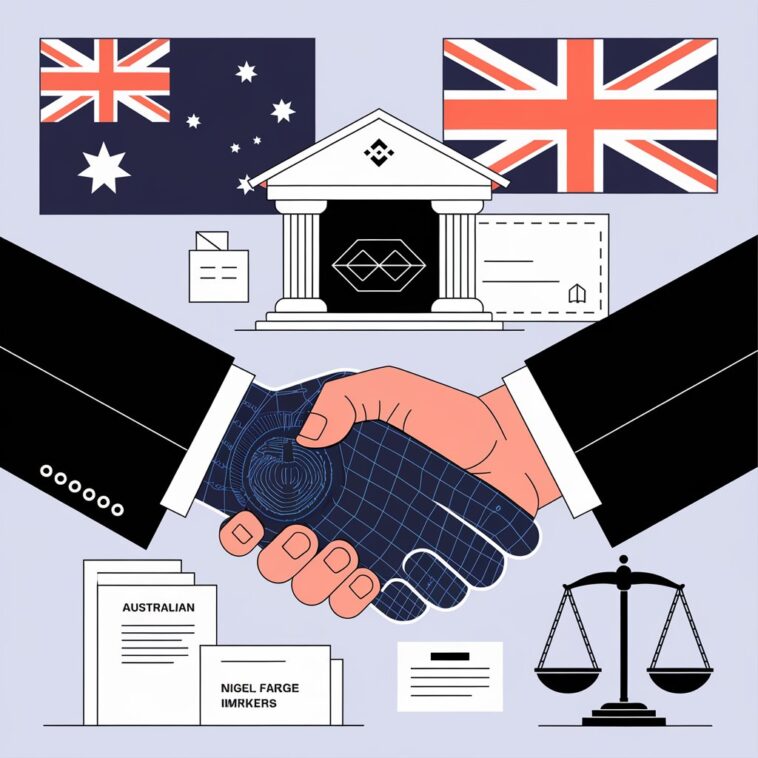

Australia: Binance Australia’s Ben Rose reported being debanked with only 12 hours’ notice and no explanation.

United Kingdom: Politician Nigel Farage’s accounts were closed in 2023 due to his political views. This led to new rules requiring banks to give three months’ notice, clear reasons for closures, and an appeals process.

Despite these efforts, UK crypto firms still face problems like account freezes, excessive paperwork, and unexplained rejections.

A Widespread Problem

The term “debanking” became so prominent in 2023 that it was shortlisted as a Collins Dictionary Word of the Year. This reflects its global impact on businesses, innovation, and free speech. While crypto leaders push for solutions, challenges persist into 2024.