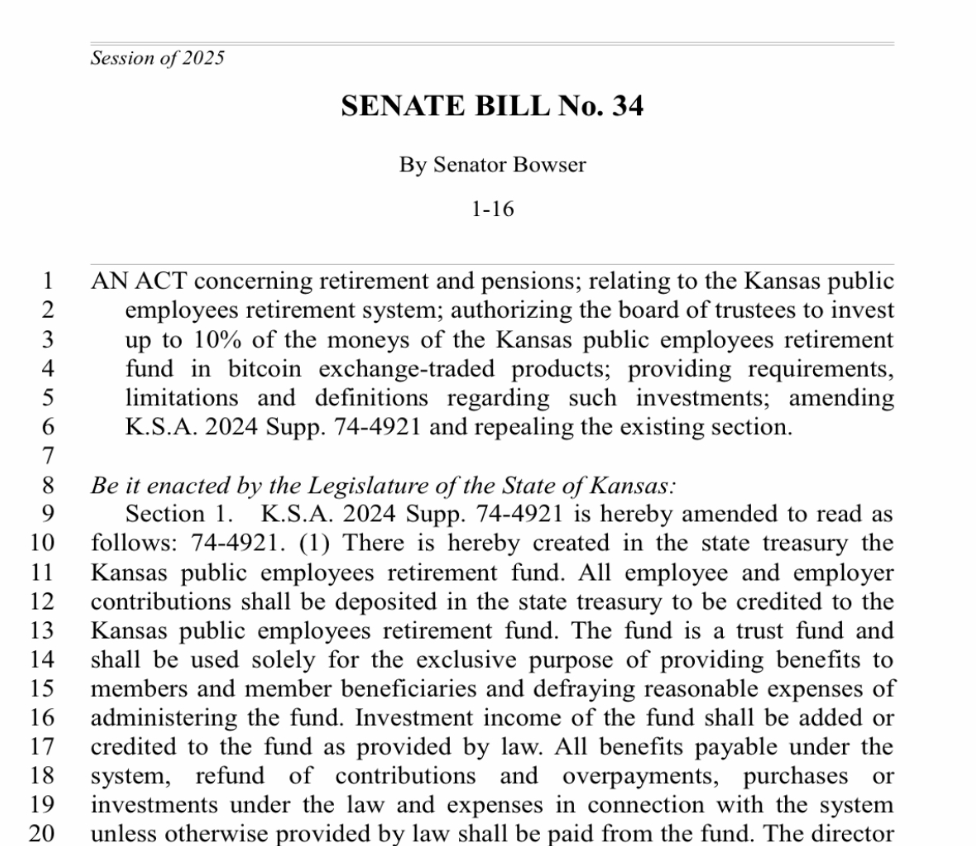

Kansas is taking a bold step toward cryptocurrency adoption with a proposed bill that seeks to allocate 10% of public employee retirement funds into Bitcoin-backed exchange-traded funds (ETFs).

Key Features of the Proposal

- Introduction of Senate Bill 34:

- Proposed by State Senator Craig Bowser, the bill aims to authorize the Kansas Public Employees Retirement System (KPERS) to invest in Bitcoin ETFs.

- Establishment of a Trustee Board:

- A board of trustees will oversee the investments, ensuring no more than 10% of the retirement fund is allocated to Bitcoin ETFs.

- If Bitcoin ETF holdings exceed this threshold, the board would not be obligated to sell unless it aligns with the beneficiaries’ best interests.

- Annual Review:

- The board must conduct an annual examination of the investment program to monitor its performance and assess risk.

Legislative Pathway

The bill was introduced on Jan. 16 and passed to the Committee on Financial Institutions and Insurance on Jan. 17. Before becoming law, it must:

- Pass four additional legislative steps.

- Be referred to the House of Representatives for a similar process.

- Receive approval or veto from the Governor of Kansas.

Shifting Attitudes Toward Crypto Investments

This proposal represents a significant shift in Kansas lawmakers’ stance on cryptocurrency:

- In 2023, a bill sought to limit political crypto donations to $100 and required immediate conversion to USD.

- The 2023 bill was ultimately removed from consideration due to legislative deadlines, highlighting past skepticism toward crypto investments.

By contrast, Senate Bill 34 demonstrates growing recognition of Bitcoin as a viable asset for long-term investments, particularly through regulated financial products like ETFs.

Why Bitcoin ETFs?

Bitcoin ETFs provide exposure to Bitcoin’s price movements without requiring direct ownership of the cryptocurrency. Benefits for retirement funds include:

- Lower Volatility Risks: ETFs are managed by regulated investment firms, adding an extra layer of oversight.

- Liquidity: Easy to buy and sell without the need for specialized wallets or platforms.

- Diversification: Adds a modern asset class to traditional portfolios.

Legislative Context

Kansas lawmakers’ decision on this bill will reflect broader trends in U.S. states considering crypto-related policies. While the federal government continues to deliberate on a unified crypto framework, states like Kansas could pave the way for institutional crypto adoption through innovative legislation.