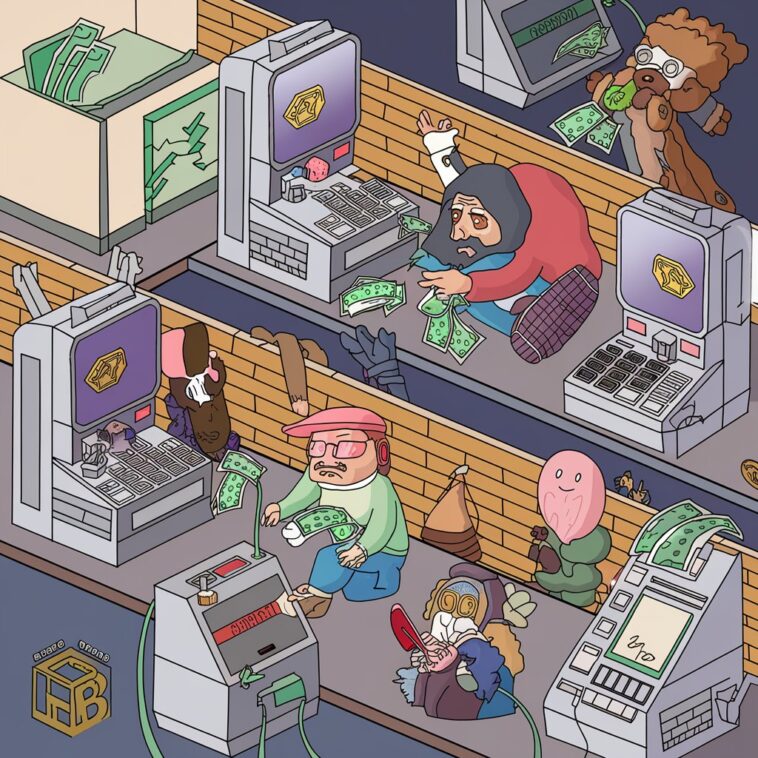

New Regulations to Combat Crypto ATM Fraud

Crypto ATMs, once a convenient way to buy and sell cryptocurrency, are now a tool for scammers. To curb this growing problem, Illinois Senator Dick Durbin has introduced a bill aimed at protecting consumers from fraud.

Announced on Tuesday, the Crypto ATM Fraud Prevention Act would impose strict transaction limits and require companies to issue refunds for victims who report fraud within 30 days.

“These common-sense rules will protect Americans—especially seniors—from losing their hard-earned money to scams,” said Durbin, urging the Senate to pass the bill.

Proposed Restrictions on Crypto ATMs

- New users can only transact up to $2,000 per day or $10,000 over 14 days.

- Transactions over $500 would require direct operator verification to prevent fraud.

- Mandatory fraud alerts and refund guarantees for victims who report scams promptly.

Durbin highlighted a New Lenox man who lost $15,000 after being tricked into paying a fake fine via a Bitcoin ATM. The scammer posed as a law enforcement officer, claiming the victim had missed jury duty and needed to pay immediately to avoid arrest.

“There was no way to trace the scammer or recover the money,” Durbin said, calling the incident part of a troubling trend.

Crypto ATM Scams on the Rise

As Bitcoin gains institutional interest, fraud cases linked to crypto ATMs are increasing. According to Federal Trade Commission (FTC) data, reported losses from crypto ATM scams have surged nearly tenfold since 2020, reaching $110 million in 2023.

Scammers often impersonate government officials or bank representatives, pressuring victims into urgent payments via crypto ATMs. The elderly are particularly vulnerable—FTC research shows people over 60 are three times more likely to fall for these scams than younger adults.

“Scammers are using these machines to take money from people more than ever before,” said Emma Fletcher, senior data researcher at the FTC.

Growing Crypto ATM Usage and Security Threats

Despite bans in some countries, Bitcoin ATMs are legal in the U.S., with nearly 29,642 machines currently in operation, according to Coin ATM Radar.

Beyond ATM fraud, crypto platforms like Bybit have also been targeted. Just last week, hackers—linked to the North Korean Lazarus Group—stole $1.4 billion in a record-breaking cyberattack, highlighting the urgent need for tighter security measures in the crypto industry.