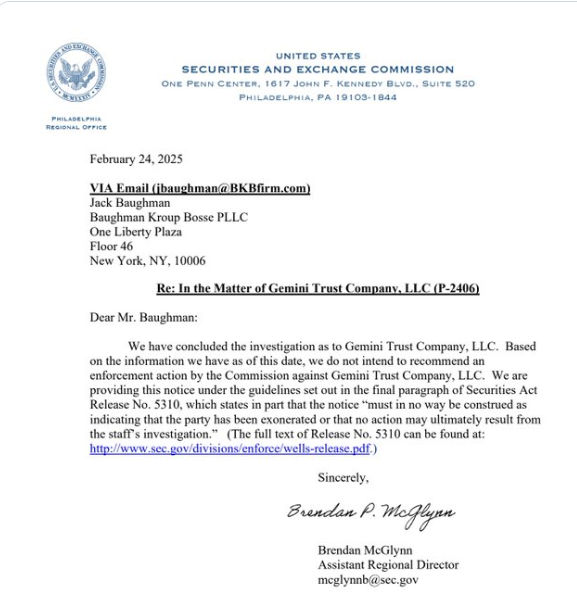

SEC Ends Probe Into Gemini

The U.S. Securities and Exchange Commission (SEC) has officially closed its investigation into crypto exchange Gemini, according to co-founder Cameron Winklevoss. In a statement on Feb. 26, the SEC confirmed it would not pursue enforcement action based on the available information.

Previous Charges Against Gemini

The SEC had accused Gemini and Genesis Global Capital of offering unregistered securities through the “Earn” program in January 2023. Despite dropping the case, the agency clarified that its decision does not prevent future action.

Winklevoss Criticizes SEC’s Impact

Winklevoss welcomed the decision but criticized the SEC for the financial and reputational damage caused. He claimed the regulator’s actions had cost Gemini millions in legal fees and hindered industry innovation.

“The SEC’s aggression has caused immeasurable economic loss and stifled crypto growth in the U.S.,” he said, arguing that other companies faced similar obstacles.

SEC Pulling Back on Crypto Enforcement

The decision aligns with a broader shift in the SEC’s approach, as recent cases against Coinbase, OpenSea, Uniswap Labs, and Robinhood Crypto have also been dropped. The change follows the departure of former SEC Chair Gary Gensler, who resigned on Jan. 20, 2025, coinciding with the start of Donald Trump’s second presidential term.

Call for Accountability

Winklevoss urged lawmakers to introduce regulations preventing baseless enforcement actions. He suggested SEC officials responsible for such cases should face penalties, including job termination, and affected firms should be reimbursed.

“Regulators cannot be allowed to harass industries and then simply walk away,” he stated. “This marks a step forward for crypto, but we must ensure this never happens again.”