A recent survey revealed that 26% of institutional investors and wealth managers support Bitcoin as a reserve asset. This growing interest in Bitcoin has led to a significant increase in its holdings by publicly listed companies.

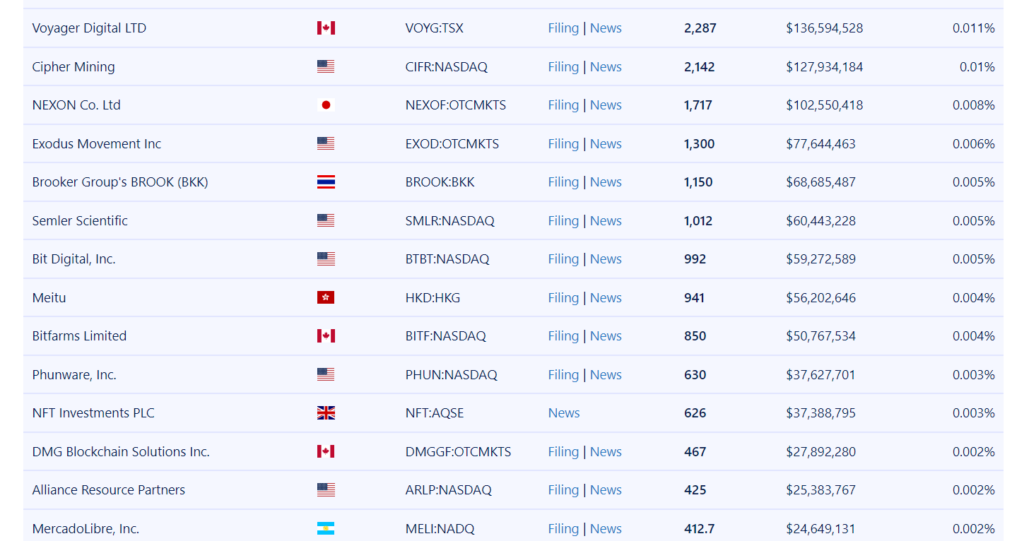

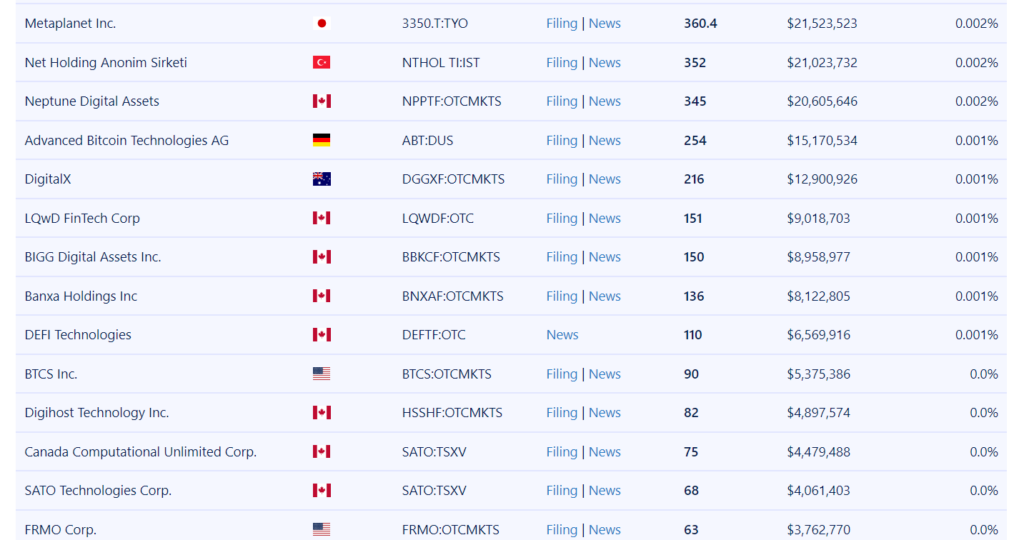

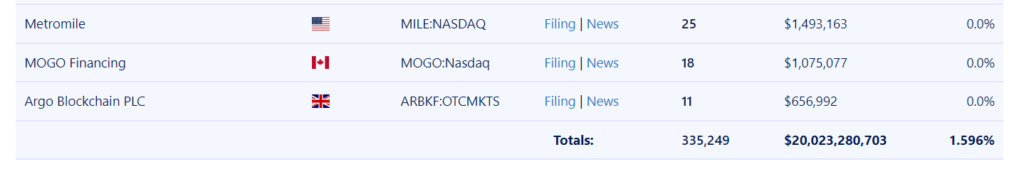

Data from Bitbo shows that 42 public companies now hold a total of 335,249 Bitcoin, valued at around $20 billion. A year ago, these holdings were worth $7.2 billion, marking a 177.7% surge in value, according to Nickel Digital Asset Management.

Source : https://treasuries.bitbo.io/

This trend began in August 2020 when business intelligence firm MicroStrategy made headlines by purchasing over 21,000 Bitcoin and designating it as their primary reserve asset. By August 2024, MicroStrategy had significantly increased its holdings to 226,500 Bitcoin, reflecting the rising corporate interest in the cryptocurrency.

Nickel Digital conducted a survey to better understand institutional attitudes toward holding Bitcoin. The study involved 200 institutional investors and wealth managers from the U.S., U.K., Germany, Singapore, Switzerland, Brazil, and the United Arab Emirates.

The findings showed that 75% of organizations already invested in the crypto space believe public companies should hold Bitcoin. Additionally, 26% of respondents strongly support using Bitcoin as a reserve asset.

Participants in the survey, managing a collective $1.7 trillion in assets, foresee continued growth in Bitcoin adoption among public companies. More than half (58%) believe that within the next five years, at least 10% of publicly listed firms will hold Bitcoin on their balance sheets. Furthermore, 8% predict that 25% or more of public companies will include Bitcoin as part of their reserves.

Nickel Digital’s CEO, Anatoly Crachilov, noted that institutional investors see Bitcoin as a valuable long-term asset, particularly as a hedge against currency debasement. Despite the current surge, the 335,249 BTC held by public companies represents only 1.6% of Bitcoin’s total supply, capped at 21 million.