Sweden is tightening its grip on cryptocurrency exchanges, classifying some as “professional money launderers” (PML) due to their involvement in organized crime. Authorities have categorized these unlicensed platforms into four distinct types based on their operations.

Authorities Label Crypto Exchanges as Money Launderers

Sweden’s Financial Intelligence Unit (FIU) and the Police Authority have labeled certain cryptocurrency exchanges as PMLs after an analysis revealed links to criminal networks. These platforms are said to facilitate systematic money laundering for various individuals and organizations involved in illegal activities.

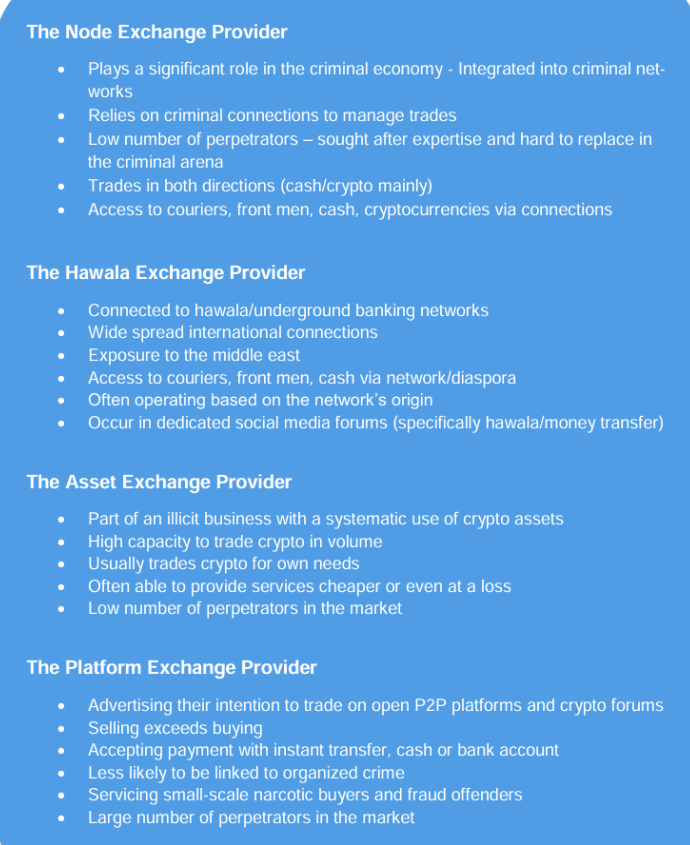

According to the FIU, crypto exchanges acting as PMLs fall into four categories:

- Node Exchange Provider: A service facilitating direct transactions between users.

- Hawala Exchange Provider: Operating like the traditional hawala system, enabling money transfers without actual movement of funds.

- Asset Exchange Provider: Facilitates the conversion of digital assets into other forms.

- Platform Exchange Provider: Manages the exchange of digital currencies through online platforms.

Increased Monitoring of Crypto Platforms

The FIU’s report suggests that law enforcement should increase their oversight on cryptocurrency exchanges to limit illegal activities. Authorities emphasized the emerging threat posed by these platforms, which are viewed as crucial tools for organized crime to grow their operations.

Legitimate crypto exchanges were acknowledged for their role in preventing illicit activities. These licensed platforms are encouraged to monitor suspicious transactions and take action when necessary, including halting operations or removing questionable clients.

Tax Crackdown on Bitcoin Miners

In addition to targeting exchanges, Swedish authorities are also focusing on the country’s crypto mining sector. The Swedish Tax Agency conducted investigations into 21 Bitcoin mining companies between 2020 and 2023, finding discrepancies in tax filings. Of the firms reviewed, 18 were found to have provided misleading or incomplete information, resulting in significant unpaid taxes.

Authorities claim that the firms underreported or incorrectly filed value-added tax (VAT), leading to a $90 million tax dispute. Some mining firms have appealed, with two cases successfully adjusted in court.

Footnote:

- Node exchange provider: A service allowing users to directly interact and transfer digital assets.

- Hawala: An informal method of transferring money without moving physical cash.

- VAT: Value-added tax applied to the production or sale of goods and services.