BlackRock, the world’s largest asset manager, is making changes to address concerns about how Coinbase handles Bitcoin for its exchange-traded funds (ETFs). In a recent update filed with the U.S. Securities and Exchange Commission (SEC), BlackRock adjusted its Bitcoin ETF terms, requiring Coinbase to process Bitcoin withdrawals within 12 hours.

Concerns Over Coinbase’s Role

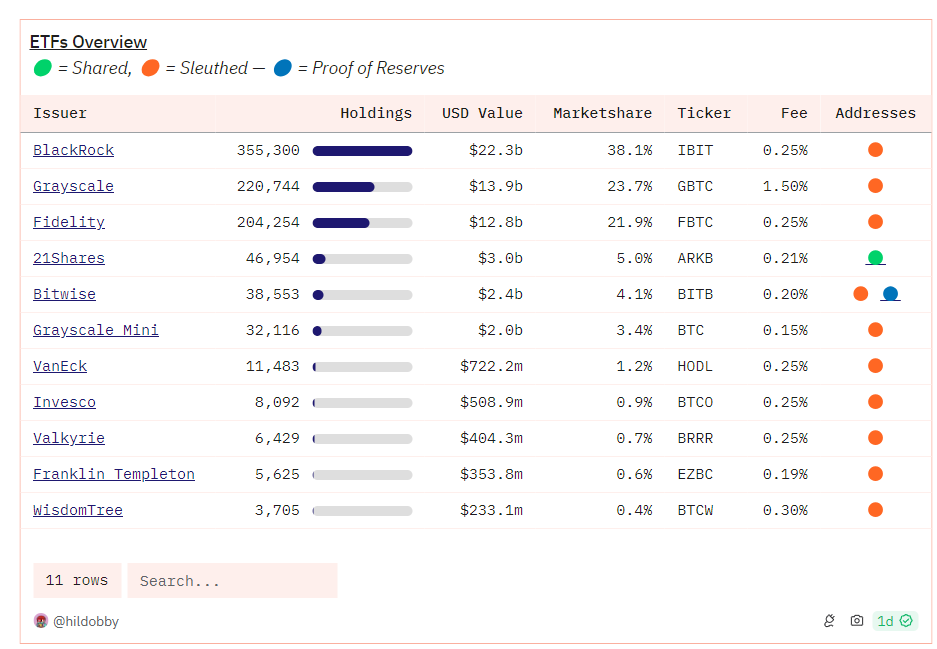

Coinbase is responsible for safeguarding the Bitcoin held in most U.S. Bitcoin ETFs, managing 10 out of 11 spot ETFs. However, some investors have raised questions about whether Coinbase is properly handling these assets, including concerns about whether the Bitcoin tied to these ETFs is being bought and stored securely.

To clear things up, BlackRock stated in the filing:

“Coinbase Custody must process Bitcoin withdrawals to a public blockchain address within 12 hours after receiving instructions from the client or their representative.”

Coinbase’s Response

In response to these concerns, Coinbase CEO Brian Armstrong reassured investors that all ETF transactions are indeed settled on the blockchain, known as “onchain.” While Coinbase doesn’t publicly share all the ETF-related addresses, Armstrong emphasized that their Bitcoin holdings are fully audited.

In a social media post, Armstrong explained:

“We’re audited annually by Deloitte since we’re a public company. Institutional clients likely don’t want their addresses disclosed, and it’s not our role to share them.”

This follows Coinbase’s announcement of a new product called Coinbase BTC (cbBTC), a form of Wrapped Bitcoin (wBTC), which has stirred up more speculation among investors.

Bitcoin Prices and the Role of ETFs

Despite these worries, some experts believe that the recent slump in Bitcoin prices isn’t due to how ETFs are managed. Eric Balchunas, a senior ETF analyst at Bloomberg, suggested that the dip is more likely caused by long-term Bitcoin holders, known as “HODLers,” selling off their assets.

Balchunas also pointed out that ETFs have actually helped stabilize Bitcoin’s price, saying:

“All the ETFs and BlackRock have done is save Bitcoin’s price from dropping even further multiple times.”

Since their launch, Bitcoin ETFs have accumulated over $59.2 billion in Bitcoin holdings. BlackRock’s iShares Bitcoin Trust (IBIT) is the largest, holding $22.5 billion. By mid-February, ETFs accounted for 75% of new Bitcoin investments, helping push the price above $50,000.

The Impact of MiCA Regulations

These changes to BlackRock’s Bitcoin ETF practices come as the European Union’s Markets in Crypto-Assets (MiCA) regulation is set to take full effect in December 2024. MiCA will introduce a new framework that aims to bring more transparency and security to the crypto market, affecting how service providers operate in Europe.