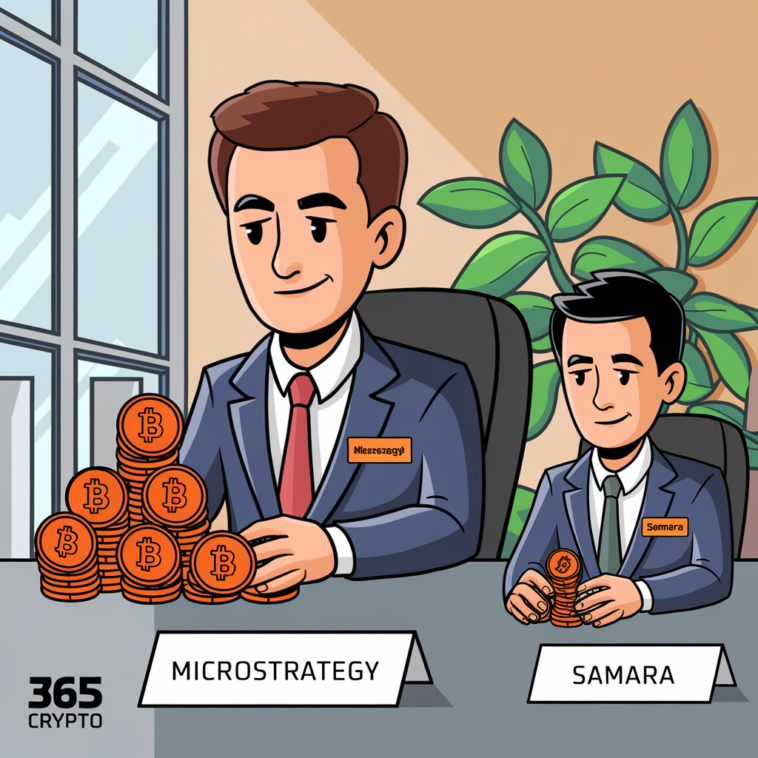

The MicroStrategy business model is spreading.

Samara Asset Group is gearing up to issue a bond worth up to €30 million ($32.8 million) to boost its Bitcoin reserves and grow its investment portfolio. Pareto Securities will manage the bond, which will be used to buy more Bitcoin and invest in other assets.

Bond Details and Investment Strategy

The bond will be listed on the Oslo and Frankfurt stock exchanges. Investors need to put in at least €100,000 ($109,000) to participate. The money raised will help Samara increase its Bitcoin holdings, which already serve as its main reserve asset.

CEO’s Comments on Bitcoin Goals

Patrick Lowry, CEO of Samara, said the bond will strengthen the company’s financial position and allow for more investments in cutting-edge technologies. Samara currently holds 421 BTC but hopes to increase that to 1,000 BTC by the end of 2024. Any extra funds that aren’t used for other investments will go toward buying more Bitcoin.

Samara’s Growth and Investments

Samara Asset Group, co-founded by Bitcoin enthusiast Mike Novogratz in 2018, is listed on the German Xetra stock exchange. The company is worth around €189 million ($206 million) and holds investments in companies like Northern Data and Deutsche Digital Assets. Samara’s move follows a trend of companies in the crypto world boosting their Bitcoin reserves.