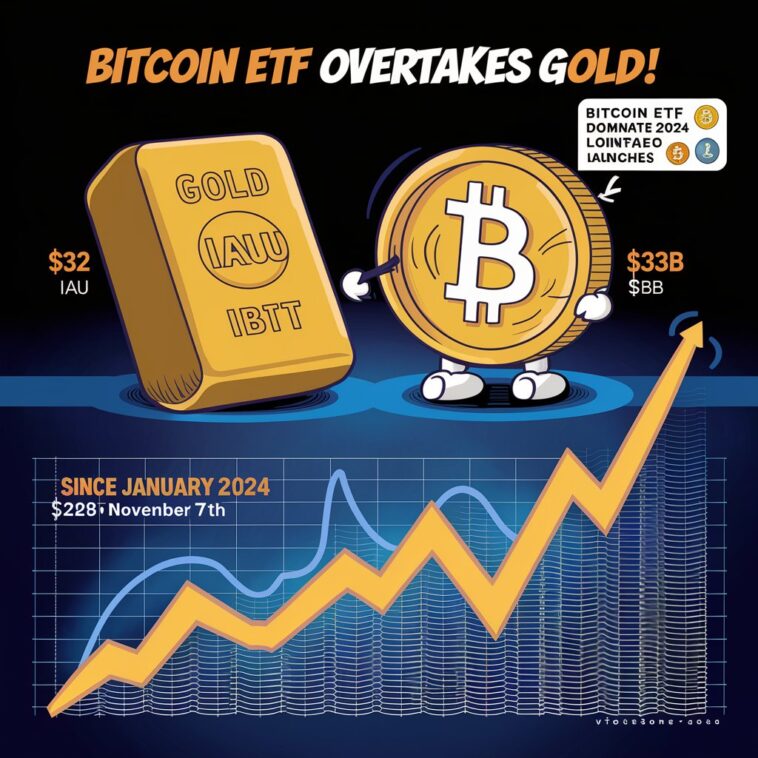

BlackRock’s Bitcoin ETF (IBIT) has now surpassed its gold ETF (IAU) in total assets. As of November 8, 2024, IBIT is worth over $33 billion, edging out the older IAU fund, which has been around since 2005.

Rapid Rise of IBIT

IBIT only launched in January 2024, but it’s already outpaced BlackRock’s long-standing gold fund. This quick success surprised many in the industry, with Nate Geraci from The ETF Store calling it “absolutely wild.”

Investors’ Strong Interest

Investor demand has been high. November 6, 2024, marked IBIT’s biggest trading day ever, followed by $1.1 billion in inflows the next day. Despite a couple of recent outflow days, IBIT is still attracting strong investor interest.

Bitcoin ETFs Lead the Pack

Bitcoin ETFs are making waves in 2024. Out of nearly 400 new ETFs launched this year, Bitcoin-focused funds dominate the list, with the top four by inflows all being Bitcoin spot ETFs—a clear sign of the growing demand for crypto investments.

Boost for Crypto ETFs After Trump’s Win

Trump’s victory in the 2024 election gave the crypto industry a major lift. This has led to a spike in regulatory filings for new crypto ETFs, including funds for altcoins like Solana, XRP, and Litecoin.