Tether Ventures into Oil

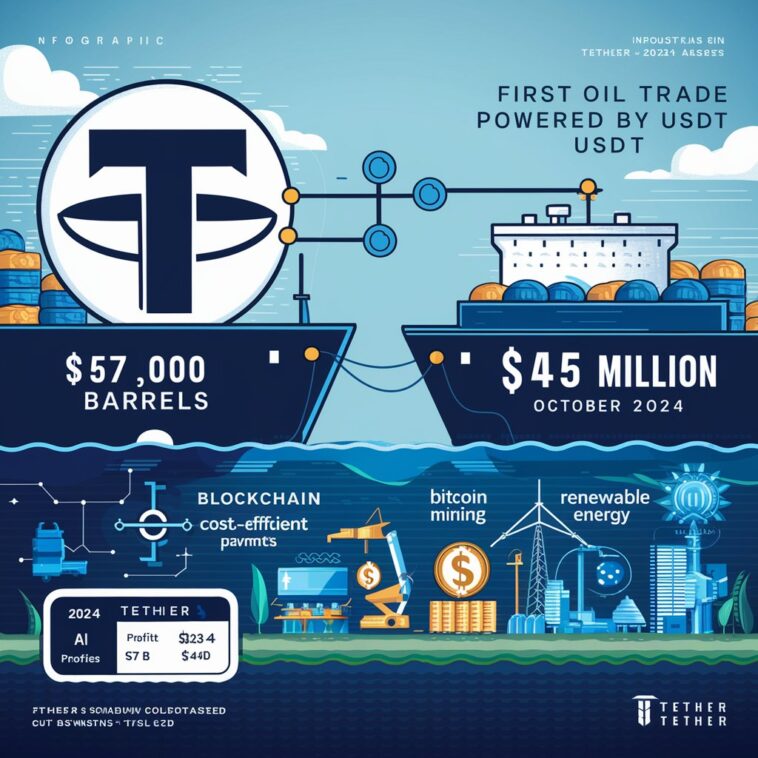

In October 2024, Tether, known for its USDt stablecoin, took its first steps into the oil market by financing a $45 million transaction. This deal helped ship 670,000 barrels of Middle Eastern crude oil, making Tether’s debut in commodities official.

How the Deal Unfolded

Announced on November 8, this transaction involved a public oil company and a commodities trader, with Tether’s Trade Finance division leading the project. Using blockchain-based USDt payments, Tether aimed to bring speed and cost-efficiency to the typically slow, bank-driven trade finance industry.

Tether’s Big Goals

Tether’s CEO, Paolo Ardoino, shared that this oil deal is just the start. Tether wants to support other industries in need of better, faster finance options. By using USDt, Tether hopes to offer global businesses new ways to handle payments that don’t rely on traditional banks.

Where the Money Comes From

Tether has had a profitable year, with earnings reaching $7.7 billion in 2024. The company’s assets total $134.4 billion, mainly in U.S. Treasury bills and a substantial Bitcoin reserve. These funds have allowed Tether to expand beyond finance and into fields like renewable energy, artificial intelligence, and Bitcoin mining.