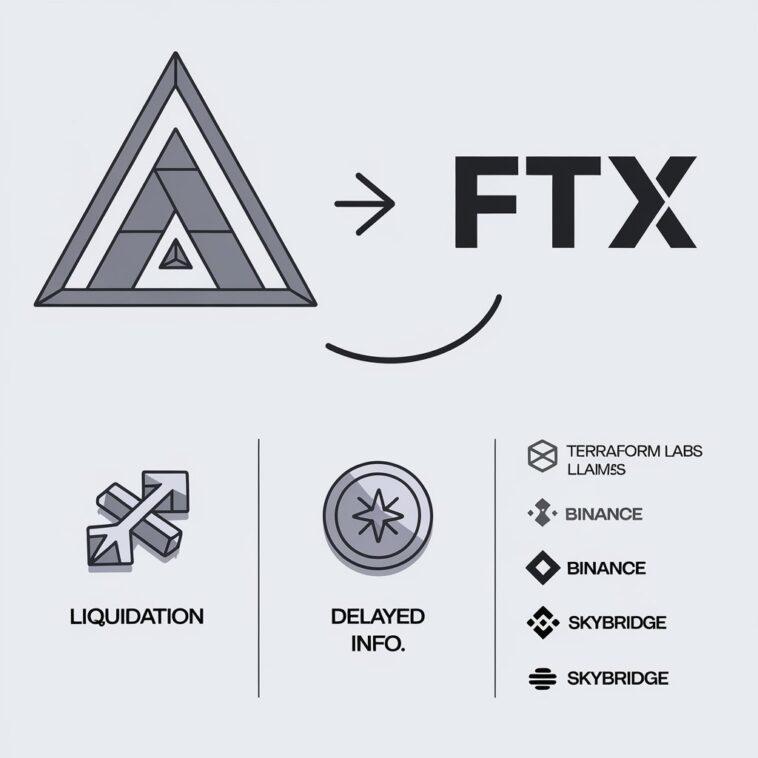

The liquidators of Three Arrows Capital (3AC) are asking the court to raise their claim against FTX from $120 million to $1.53 billion. They argue that FTX wrongly liquidated 3AC’s assets to settle a $1.33 billion debt just before the hedge fund collapsed.

What 3AC Claims Happened

3AC says FTX undervalued its assets during the liquidation and broke agreements. The liquidators also accuse FTX of delaying important information, making it hard for 3AC to figure out exactly how much it lost. They only confirmed the full amount in August.

FTX says an unknown person connected to 3AC triggered the liquidation, but they haven’t identified who it was yet. The court will discuss 3AC’s request on November 20.

Going After Other Firms

Besides FTX, 3AC is also trying to recover $1.3 billion from Terraform Labs. They claim Terra misled them about the stability of its assets, including the failed stablecoin TerraUSD (UST) and the Luna token. 3AC says these misleading claims inflated the value of these assets, leading them to invest heavily.

FTX’s Own Legal Battles

Meanwhile, FTX is suing to recover some of its own losses. In November, it filed a $100 million lawsuit against SkyBridge Capital, aiming to get back money from deals made by its former CEO, Sam Bankman-Fried. FTX is also suing Binance and Waves to recover assets that are part of its bankruptcy case.