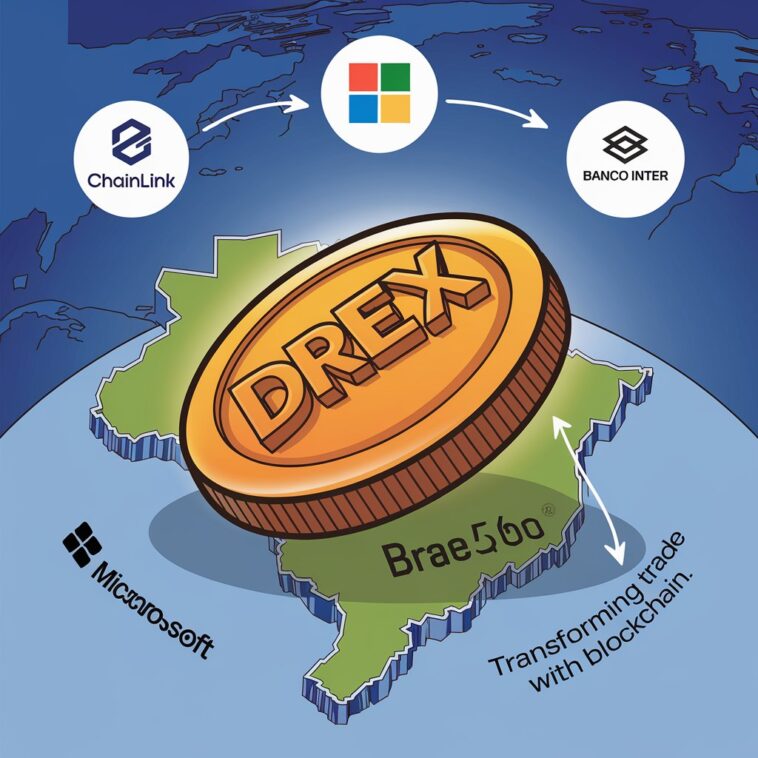

Brazil’s central bank is testing its digital currency, Drex, in a new way. This second phase focuses on making global trade and supply chains faster and easier by using blockchain technology. Big names like Chainlink, Microsoft, and Banco Inter are working together on the project.

How It Works

This phase introduces tools to simplify and secure international trade, including:

Digital Trade Documents (eBOL): Replacing paper documents with blockchain-based ones.

Payment Systems:

Delivery-versus-Payment (DvP): Goods are only delivered after payment is confirmed.

Payment-versus-Payment (PvP): Payments in different currencies happen at the same time.

These tools aim to speed up payments, reduce errors, and make trading across borders more transparent.

Who’s Doing What?

Chainlink: Connects different blockchains securely so transactions can run smoothly.

Microsoft: Provides cloud services to handle all the tech.

Banco Inter: Leads the project in Brazil, using it to expand opportunities for businesses.

7Comm: Helps integrate blockchain technology into the system.

Why It Matters

Brazil sees this as a chance to innovate and grow its economy. Using blockchain and digital currency could fix delays and inefficiencies in global trade while also making Brazil more competitive.

According to Banco Inter’s Bruno Grossi, this project could transform the market and help strengthen the country’s financial systems.

Looking Ahead

The pilot will run through 2025, testing ways to use digital assets for trade and government bonds. It’s part of Brazil’s push to bring advanced financial tools into its banking system and make international trade more efficient.