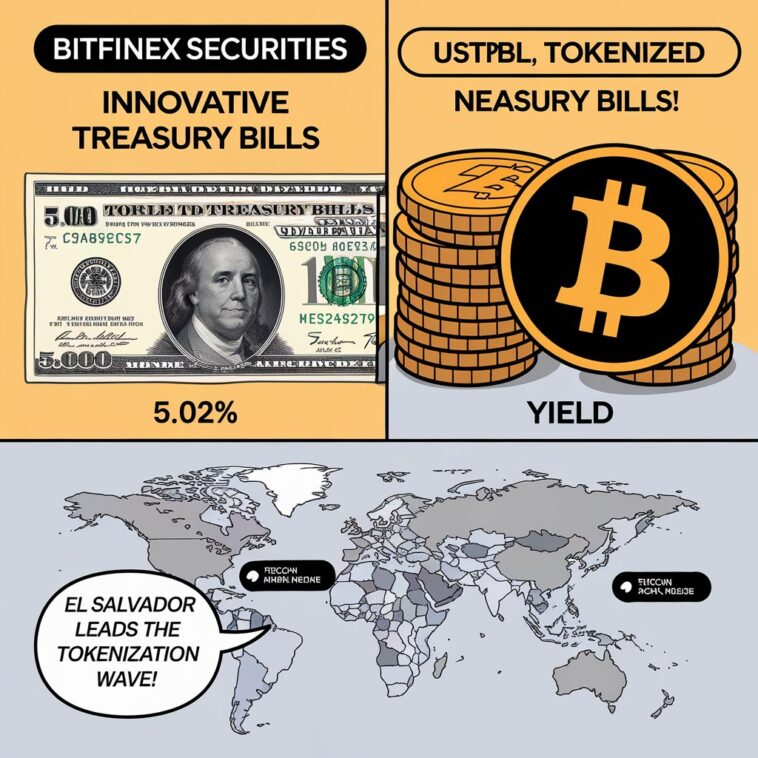

Bitfinex Securities, a Tether-affiliated platform, is bringing tokenized U.S. Treasury bills (T-bills) to investors through El Salvador’s progressive regulations. This project blends traditional finance with blockchain innovation.

USTBL: The Tokenized Treasury

The USTBL token, issued by NexBridge Digital Financial Solutions, offers exposure to short-term U.S. T-bills. Bitfinex Securities aims to raise at least $30 million during the subscription period from November 19 to November 29.

Built on Bitcoin’s Liquid Network

USTBL is the first regulated tokenized T-bill offering using Bitcoin’s Liquid Network, a layer-2 blockchain solution. It offers an annual yield of 5.02% to maturity, making it a reliable, low-risk option for investors.

How to Participate

Initially, investors can buy USTBL using USDt, Tether’s stablecoin, with Bitcoin payments planned later. After the subscription period, the token will be traded on Bitfinex Securities’ platform, allowing for instant settlements, secure withdrawals, and OTC trading.

El Salvador’s Role

This offering is supported by El Salvador’s Digital Assets Securities Law, which simplifies the tokenization of assets. Bitfinex Securities obtained a local license in April 2023, enabling innovative projects like USTBL.

Who Can Invest?

The offering is available worldwide except for North American and sanctioned country investors.