Abu Dhabi’s Sovereign Fund Invests $436M in BlackRock’s Bitcoin ETF

Abu Dhabi’s Mubadala Sovereign Wealth Fund has made a major move into Bitcoin, investing $436 million in BlackRock’s iShares Bitcoin ETF (IBIT). This investment, disclosed in a recent SEC filing, signals growing institutional interest in digital assets.

Mubadala Becomes a Top Bitcoin ETF Investor

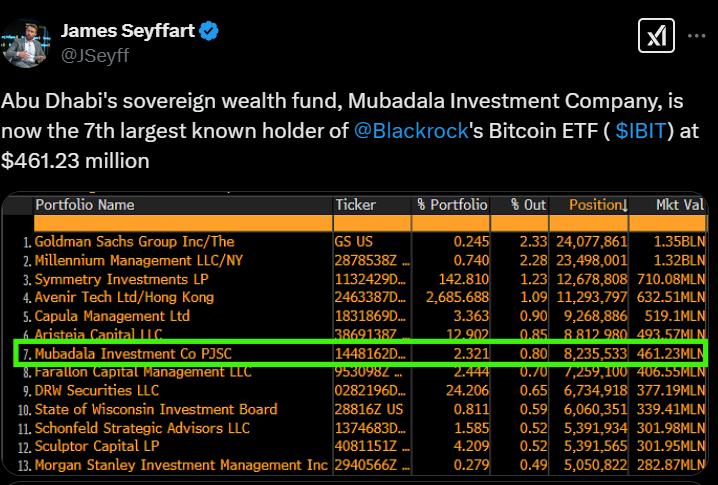

Mubadala’s purchase of over 8.2 million IBIT shares makes it the seventh-largest known holder of the ETF. The fund joins a list of top institutional investors, including Goldman Sachs and Millennium Management.

Binance founder Changpeng Zhao noted that Mubadala is just one of Abu Dhabi’s sovereign wealth funds, suggesting that other state-backed entities might also be investing in Bitcoin ETFs.

UAE’s Crypto-Friendly Strategy

Mubadala’s investment aligns with the UAE’s push to become a global hub for blockchain and digital assets. The country has introduced progressive regulations, attracting major crypto firms and investors.

The Global Race for Bitcoin Adoption

Mubadala’s move reflects a broader trend of governments and institutions increasing Bitcoin exposure. In the US, lawmakers are discussing a potential national Bitcoin reserve. Senator Cynthia Lummis has proposed the Bitcoin Act of 2024, which would sell government gold to buy Bitcoin, securing 1 million BTC.

While the federal stance remains unclear, over 20 US states have introduced legislation supporting Bitcoin investments. Analysts predict the US could emerge as a leading pro-Bitcoin nation.