SEC Moves Closer to Approving ETH Staking

The United States may soon see Ether ETFs offering staking options, according to Bloomberg Intelligence analyst James Seyffart. After the SEC recently approved options trading for spot Ether ETFs, staking could be next in line for regulatory approval.

The SEC’s green light for Ether ETF options follows its earlier approval of Bitcoin ETF options in September 2024. This step has many believing that staking approval is only a matter of time.

What’s Staking, Anyway?

In simple terms, staking is when crypto holders lock up their ETH tokens to help secure the Ethereum network. In return, they earn rewards — like interest on savings, but with way cooler technology behind it.

For ETFs, staking could add an entirely new income stream for investors, beyond just hoping ETH’s price goes up.

When Will It Happen?

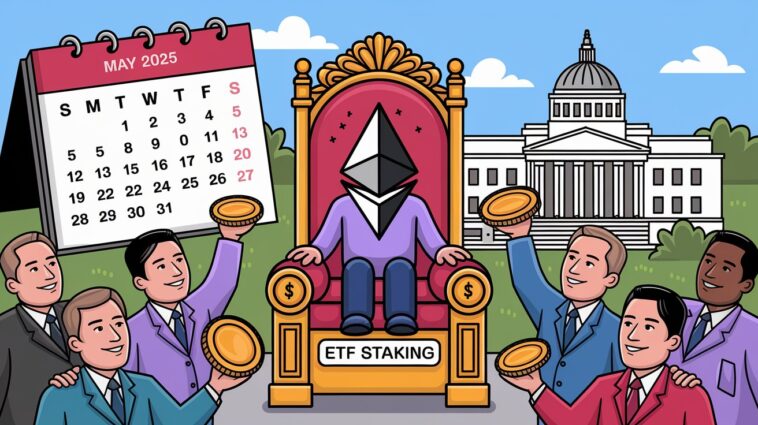

Seyffart predicts that Ether ETF staking could be approved by late May 2025. But there’s a catch — if things get delayed, the final deadline could stretch all the way to October 2025.

He noted there are possible intermediate decision points before the final word, with key dates in late May and late August.

Why It Matters for Investors

If staking gets approved, Ether ETFs would become much more attractive. Investors would not only be exposed to ETH’s price but could also earn passive rewards through staking.

Plus, staking in a regulated ETF would allow investors to enjoy the benefits of crypto without having to manage wallets, keys, or complicated DeFi platforms.

For now, all eyes are on the SEC’s next move. Will May be the month staking goes mainstream? Time — and regulators — will tell.