New Licensing Rules for Crypto Exchanges in Australia

Australian regulators are planning to enforce stricter regulations for cryptocurrency exchanges, requiring them to obtain financial services licenses. The move goes beyond current requirements for digital currency exchanges, with the Australian Financial Review (AFR) reporting that the Australian Securities and Investments Commission (ASIC) is leading this initiative.

ASIC’s Expanded Oversight of Crypto

ASIC Commissioner Alan Kirkland announced that many major cryptocurrencies, like Bitcoin and Ether, will now be subject to the Corporations Act, meaning crypto firms will need financial services licenses to operate. Speaking at the AFR Crypto and Digital Assets Summit in Sydney, Kirkland emphasized that this change is necessary to ensure proper regulation of the crypto market in Australia.

Updated Regulatory Guidance Coming Soon

ASIC is preparing to release updated guidelines, clarifying how specific crypto tokens and products will be treated under current laws. Commissioner Kirkland stressed that while ASIC supports innovation in the crypto sector, it is also concerned about protecting consumers and preventing market misconduct. The updated guidance will be open for feedback from the industry, and licensing will help reduce risks while increasing consumer confidence and market integrity.

Criticism of Australia’s Crypto Regulation

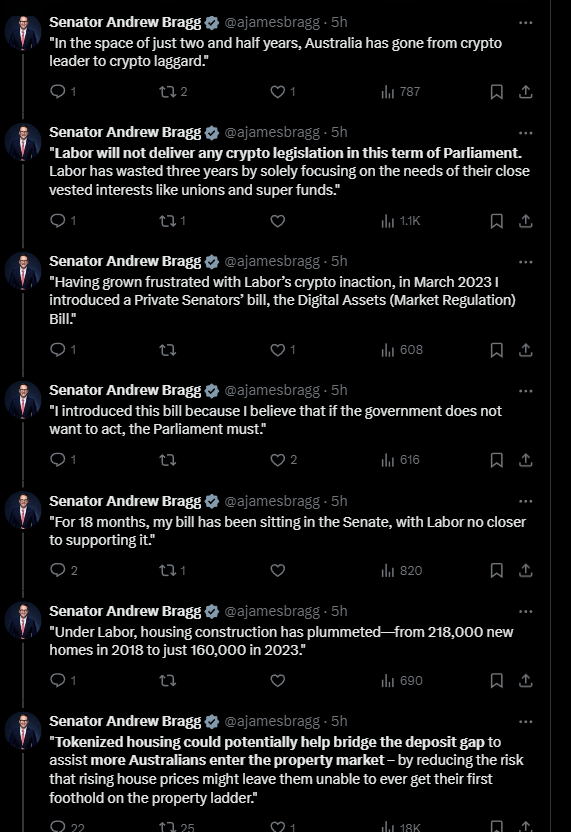

Senator Andrew Bragg Criticizes Government’s Crypto Approach

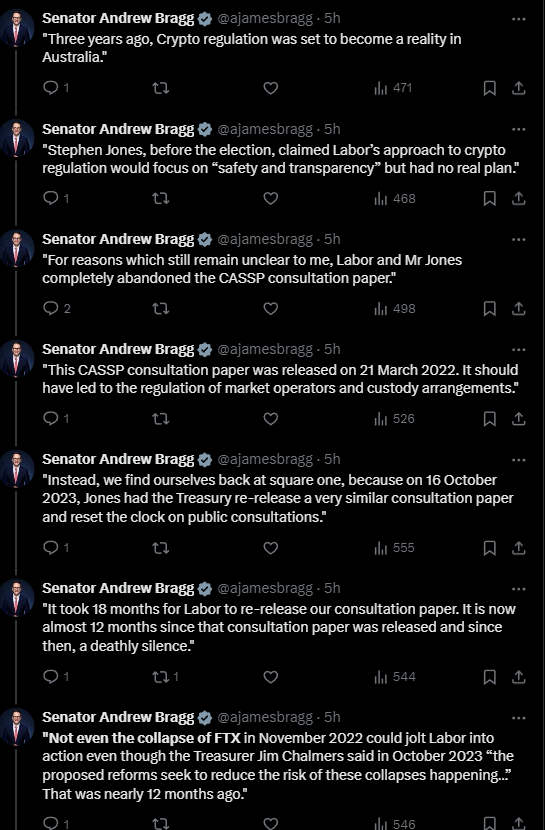

Senator Andrew Bragg has voiced strong criticism against Australian regulators for falling behind in the global crypto race. Speaking at the same AFR event, Bragg argued that Australia, once a leader in crypto regulation, has now become a laggard. He pointed out that the government, led by the Labor Party, had initially promised to focus on safety and transparency in crypto but has since abandoned its 2022 regulatory framework.

Delays in Crypto Legislation

According to Bragg, the government re-released a consultation paper after 18 months but has not made significant progress. He also predicted that no crypto legislation will be passed during the current term of Parliament, accusing the government of slowing down innovation by failing to act swiftly.

Earlier in 2024, a committee recommended delaying the passing of Senator Bragg’s crypto regulation bill, which had proposed rules for stablecoins, exchange licensing, and custody requirements.