Guggenheim Treasury Brings $20M to Ethereum Through Tokenization

Guggenheim’s Blockchain Move

Wall Street’s Guggenheim Treasury Services has tokenized $20 million in commercial paper on the Ethereum blockchain. This marks a significant development, as it is the first time commercial paper—a short-term borrowing method used by companies—has been digitized on Ethereum.

Understanding Commercial Paper Commercial paper is a short-term, unsecured loan that businesses use to cover immediate costs. Guggenheim’s digital version of commercial paper received the top credit rating from Moody’s, P-1.

Zeconomy’s Platform

The tokenization process was facilitated by Zeconomy’s AmpFi.Digital platform, a blockchain tool designed to manage and trade tokenized securities. The digitized commercial paper will be traded like traditional commercial paper but with faster settlement times and fractional ownership opportunities.

Rising Interest in Tokenization

Zeconomy’s CEO, Giacinto Cosenza, highlighted the growing demand for digital assets, driven by the approval of exchange-traded funds (ETFs) and the overall expansion of the tokenization market.

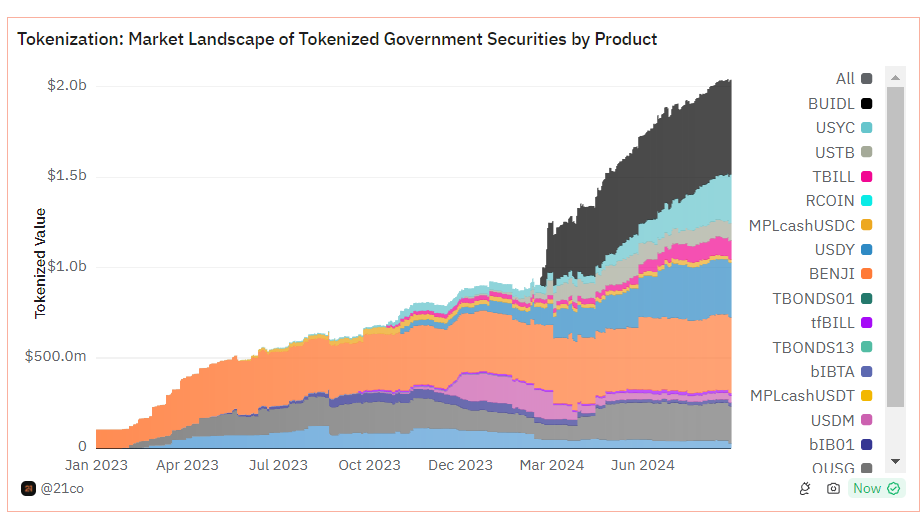

Increasing Use of Tokenized Government Securities

Government securities that have been tokenized are now worth $1.9 billion, with BlackRock leading the way by holding more than $522 million in tokenized securities on the blockchain.

Future Outlook for Tokenized Assets

Chainlink’s recent report predicts that the global market for tokenized assets could reach $10 trillion by 2030. The growth is expected to come from institutional involvement, advances in blockchain, and regulatory progress. Today, tokenized assets are valued at $118.57 billion, with Ethereum holding the largest share at 58%.

Footing:

- Tokenization: The process of converting an asset into a digital token that can be traded on a blockchain.

- Commercial Paper: A short-term, unsecured loan that companies use to manage immediate financial needs.