Bitcoin on Microsoft’s Radar

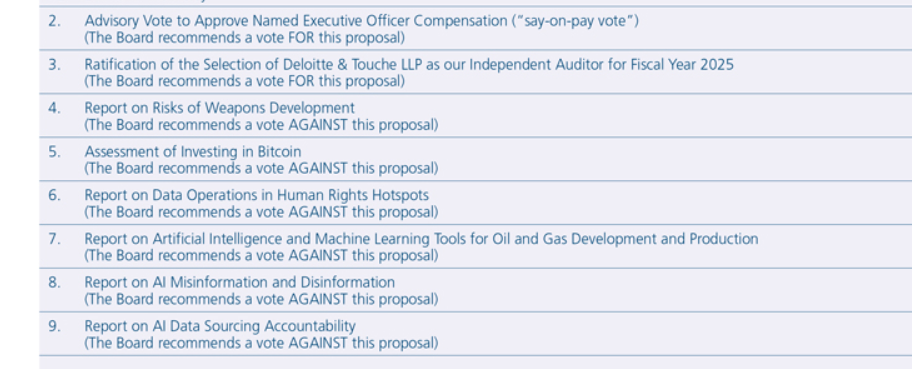

At its upcoming December 10 meeting, Microsoft shareholders will vote on whether the company should consider investing in Bitcoin. But there’s a twist—Microsoft’s Board is recommending shareholders vote against the proposal, saying the company already thoroughly evaluates all potential investments, including cryptocurrencies like Bitcoin.

The Proposal

The proposal, put forward by the National Center for Public Policy Research, argues that during periods of high inflation, companies should look beyond traditional investments like bonds and consider assets like Bitcoin. The reasoning? Bitcoin has outperformed other assets over the past year, with its price increasing by nearly 100%. The proposal suggests that even investing just 1% of Microsoft’s assets in Bitcoin could help protect shareholder value.

The proposal highlights that companies like MicroStrategy, which have invested in Bitcoin, have seen their stock prices skyrocket, and it encourages Microsoft to take a similar approach to diversify its balance sheet.

Microsoft’s Response

Despite the proposal’s arguments, Microsoft’s Board disagrees. They argue that Microsoft already has a well-thought-out investment strategy, managed by their Global Treasury team, which evaluates a wide range of assets to ensure the company’s operations are funded smoothly. The team considers many factors, including inflation protection, and has previously reviewed Bitcoin as an option.

However, Microsoft’s Board is cautious about Bitcoin’s volatility. For a company like Microsoft, stability and predictability in investments are key, and Bitcoin’s fluctuations make it less appealing for corporate purposes. Therefore, the Board believes a new public assessment of Bitcoin, as suggested by the proposal, is unnecessary.

\

Proposal 5: Assessment of Investing in Bitcoin (Shareholder Proposal)

National Center for Public Policy Research has advised us that they intend to submit the following proposal for consideration at the Annual Meeting.

Bitcoin Diversification Assessment

Supporting Statement:

In periods of consistent, and often rampant, inflation, a company’s financial standing is unfortunately measured not only by how well it conducts its business, but also by how well it stores the profits from its business.

Corporations that invest their assets wisely can, and often do, increase shareholder value more than more profitable businesses that don’t. Therefore, corporations have a fiduciary duty to maximize shareholder value not only by working to increase profits, but also by working to protect those profits from debasement.

The average inflation rate in the US over the last four years according to the CPI – which is a remarkably poor and corrupt measure of inflation – is 5.03%1, peaking at 9.1% in June, 2022. But in reality, the true inflation rate is significantly higher than that, with some studies estimating it to be nearly double the CPI at times.2 So a corporation’s assets have needed to appreciate at those rates over the last four years just to break even.

As of March 31, 2024, Microsoft Corporation has $484 billion in total assets,3 the plurality of which are US government securities and corporate bonds that barely outpace inflation (if assuming that the CPI is accurate, which it isn’t, so bond yields are actually lower than the true inflation rate).

Therefore, in inflationary times like these, corporations should – and perhaps have a fiduciary duty to – consider diversifying their balance sheets with assets that appreciate more than bonds, even if those assets are more volatile short-term.

As of June 25, 2024, the price of Bitcoin increased by 99.7% over the previous year,4 outperforming corporate bonds by roughly 94% on average.5 Over the past five years, the price of Bitcoin increased by 414%,6 outperforming corporate bonds by roughly 411% on average.7

Microstrategy – which, like Microsoft, is a technology company, but unlike Microsoft holds Bitcoin on its balance sheet – has had its stock outperform Microsoft stock this year by 313%8 despite doing only a fraction of the business that Microsoft has. And they’re not alone. The institutional and corporate adoption of Bitcoin is becoming more commonplace. Microsoft’s second largest shareholder, BlackRock, offers its clients a Bitcoin ETF.

Bitcoin is a more volatile asset, at the moment, than corporate bonds, so companies should not risk shareholder value by holding too much of it. However, as Bitcoin is an excellent, if not the best, hedge against inflation and corporate bond yields are less than the true inflation rate, companies should also not risk shareholder value by ignoring Bitcoin altogether. At minimum, companies should evaluate the benefits of holding some, even just 1%, of its assets in Bitcoin.

Resolved: Shareholders request that the Board conduct an assessment to determine if diversifying the Company’s balance sheet by including Bitcoin is in the best long-term interests of shareholders.

Board Recommendation

The Board of Directors recommends a vote AGAINST the proposal for the following reasons:

COMPANY STATEMENT IN OPPOSITION

This proposal requests that the Board conduct an assessment that is unnecessary because Microsoft’s management already carefully considers this topic.

Microsoft’s Global Treasury and Investment Services team evaluates a wide range of investable assets to fund Microsoft’s ongoing operations, including assets expected to provide diversification and inflation protection, and to mitigate the risk of significant economic loss from rising interest rates. Past evaluations have included Bitcoin and other cryptocurrencies among the options considered, and Microsoft continues to monitor trends and developments related to cryptocurrencies to inform future decision making.

As the proposal itself notes, volatility is a factor to consider in evaluating cryptocurrency investments for corporate treasury applications that require stable and predictable investments to ensure liquidity and operational funding.

Microsoft has strong and appropriate processes in place to manage and diversify its corporate treasury for the long-term benefit of shareholders and this requested public assessment is unwarranted.