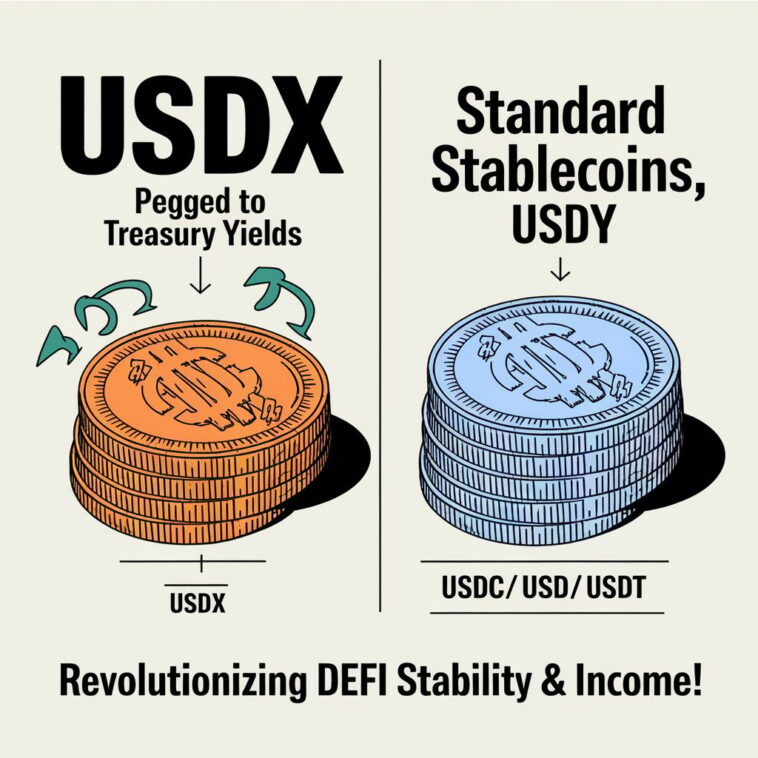

Stablecoins linked to U.S. Treasury yields, like Flare Network’s USDX, are shaking up decentralized finance (DeFi). These coins aim to bring liquidity and stability by offering a safer, yield-driven alternative to traditional stablecoins like USDC and USDT.

What Makes USDX Different?

USDX is built on Flare, a blockchain made for connecting different crypto networks. The big idea? Tie digital assets to real-world Treasury yields. This makes USDX more secure and useful for DeFi markets compared to older stablecoins.

USDX vs. the Competition

USDX’s edge is its ability to generate yield through Clearpool while locked in Flare’s system. Flare’s co-founder Hugo Philion says this feature makes USDX more appealing for users. However, USDX still needs to be fully validated by Flare’s oracle system before it hits the market, which has caused delays.

Critics worry these delays might hurt USDX’s chances in the crowded stablecoin market. Philion doesn’t see it that way, saying crypto is still young, and it’s more important to build things right than to rush.

Earning Treasury Yields in DeFi

With USDX, you can stake your stablecoins in Flare’s Clearpool vaults and earn returns based on real Treasury yields. This makes it a low-risk option for DeFi investors looking for steady income.

Playing it Safe with FAssets

Flare Labs is being careful with its FAsset system, which creates new digital assets. By limiting supply in the early stages, they hope to avoid problems like overexpansion or regulatory trouble. Philion believes this slow growth is the key to building something that lasts.