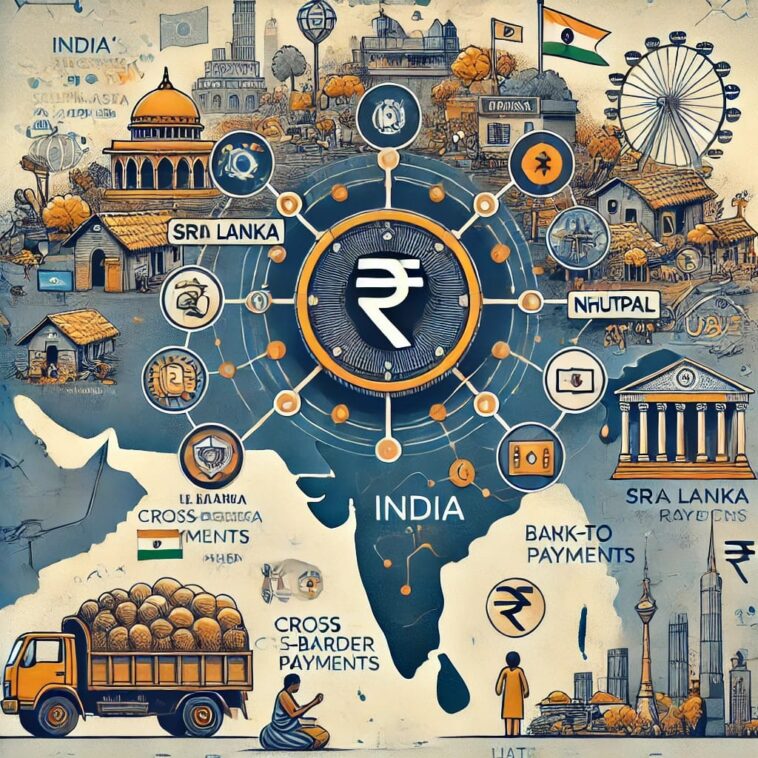

India’s central bank, the RBI, is upgrading its cross-border payment system for faster transactions. Agreements are already in place with Sri Lanka, Bhutan, and Nepal, and the UAE is expected to join next.

Role of Digital Currency

India is exploring CBDCs for cross-border transactions. The current system focuses on bank-to-bank payments, but it may expand to retail users in the future.

India’s CBDC Journey

Since 2020, India has been testing digital currency. By 2024, 5 million people were using the RBI’s pilot digital rupee program. Efforts are underway to create offline functionality for rural areas and to enable seamless global transactions with interoperable systems.

Critics Speak Out

While CBDCs promise efficiency, critics warn they could lead to government overreach and misuse of personal data, raising serious privacy concerns.