MicroStrategy just went even deeper into Bitcoin. From Nov. 18–24, they bought 55,000 BTC for $5.4 billion, paying $97,862 per coin on average.

Total Bitcoin Now? 386,700 BTC

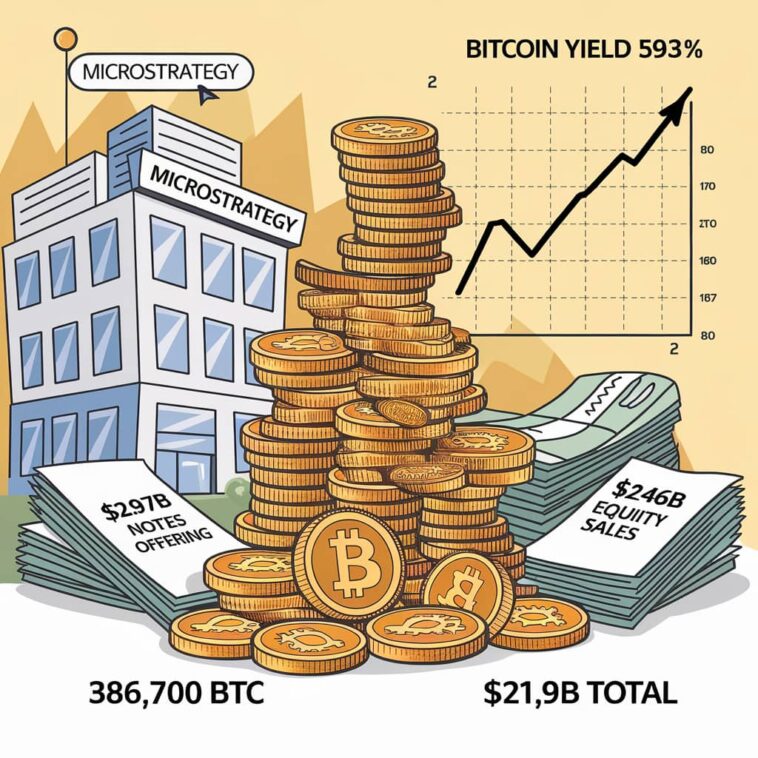

After this latest splurge, MicroStrategy owns a whopping 386,700 Bitcoin. Altogether, they’ve spent $21.9 billion, with an average price of $56,761 per Bitcoin. The company clearly believes Bitcoin’s value is far from its peak.

Where’s All This Money Coming From?

Here’s how they funded the massive purchase:

- Notes Offering: A private deal raised $2.97 billion.

- Equity Sales: Selling 5.6 million shares added $2.46 billion.

And they’re not done. There’s still $12.8 billion left in their equity program for future Bitcoin buys.

Tracking Bitcoin’s Impact

MicroStrategy created a metric called “Bitcoin Yield” to measure how their Bitcoin investments boost shareholder value. By Nov. 24, their yield hit 59.3%, up from 35.2% last quarter, proving Bitcoin is now central to their strategy.

Not Just MicroStrategy

Semler Scientific, a healthcare company, is following suit. Between Nov. 18–22, they bought 297 BTC for $29.1 million at $75,039 per coin. They now own 1,570 BTC and report a Bitcoin Yield of 58.4%.