Polygon has $1.3 billion in stablecoins just sitting there, doing nothing. Allez Labs thinks that’s a missed opportunity. They’ve proposed a plan to generate $70 million a year by putting those funds to work in decentralized finance (DeFi).

Here’s How It Works

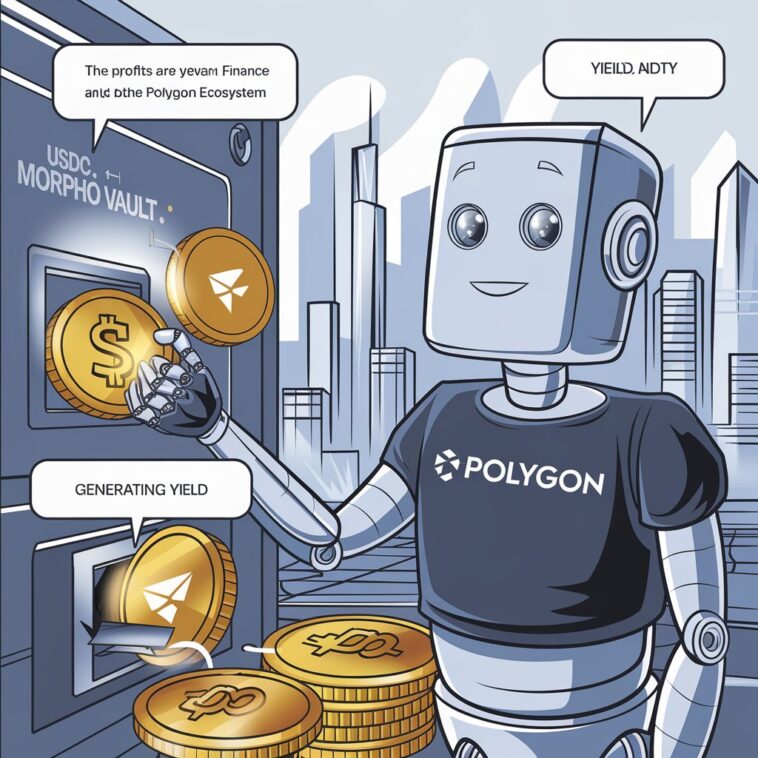

Stablecoins like USDC, USDT, and DAI would be deposited into Morpho Vaults, managed by Polygon and curated by Allez Labs. These vaults would earn yield through decentralized lending. The profits? They’d go to Yearn Finance, which would reinvest them into Polygon’s ecosystem, helping fund new projects and incentives.

Why It Matters

This plan could transform idle cash into a powerful tool for growth, fueling innovation and solidifying Polygon’s role in the DeFi world. It’s a win-win for everyone involved.