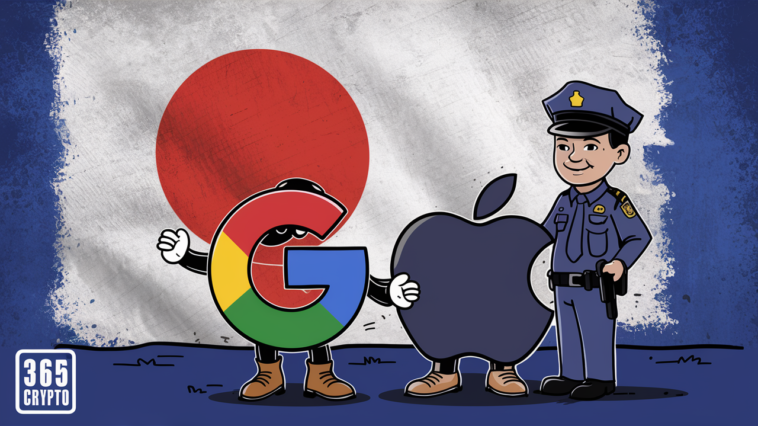

Japan Enforces Stricter Crypto Regulations

- Japan’s Financial Services Agency (FSA) has requested Apple and Google to suspend downloads of five unregistered cryptocurrency exchanges.

- The affected platforms include Bybit Fintech, MEXC Global, LBank Exchange, KuCoin, and Bitget.

- Apple complied with the request on February 6, removing the applications from its App Store for Japanese users.

Japan’s Cautious Approach to Cryptocurrency

- Unlike Hong Kong, which has approved spot Bitcoin and Ether exchange-traded funds (ETFs), Japan remains wary of crypto ETF risks.

- The FSA’s move is not a crackdown on crypto investing but an effort to enforce compliance with Japanese regulations.

Regulatory Compliance Over Market Ban

- Blockchain expert Anndy Lian emphasized that the action is about maintaining regulatory integrity rather than banning crypto investments.

- “Japan has always prioritized consumer protection and market integrity,” Lian stated, reinforcing the nation’s proactive regulatory stance.

- The FSA’s decision follows a recent tax reform that treats crypto assets similarly to traditional financial assets.

Japan’s Regulatory Framework Prioritizes Investor Protection

- Japan’s regulatory measures aim to prevent past market failures, such as the Mt. Gox collapse in 2014, which resulted in over $9.4 billion in losses.

- In July 2024, Mt. Gox made significant progress in creditor repayments, distributing 59,000 Bitcoin to affected investors.

- Exchanges wishing to operate in Japan must now adhere to the country’s stringent compliance requirements.