The U.S. Securities and Exchange Commission (SEC) recently published a document titled “XRP as a Strategic Financial Asset for the U.S.”

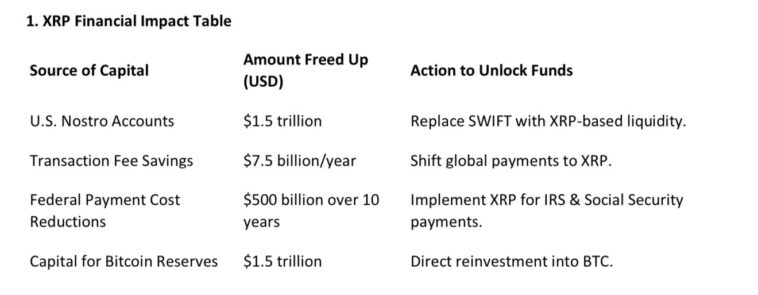

This document explores the potential integration of XRP into various government payment systems, including tax refunds and Social Security disbursement.

Key Highlights from the SEC Document:

- Replacing SWIFT with XRP-Based Liquidity: The proposal suggests that utilizing XRP could unlock approximately $1.5 trillion from U.S. Nostro accounts by replacing the traditional SWIFT system with XRP-based liquidity solutions.

- Transaction Fee Savings: Implementing XRP is projected to save around $7.5 billion annually in transaction fees.

- Pilot Program: The document outlines a 6-12 month pilot phase targeting IRS tax refunds and Social Security payments as initial use cases for XRP integration.

- Implementation Timeline: It proposes both standard (24-month) and accelerated (6-12 month) plans for broader adoption of XRP within the U.S. financial infrastructure.

- Regulatory Recommendations: The SEC is advised to classify XRP as a payment network rather than a security, accompanied by an official clarification and settlement with Ripple. Additionally, the Department of Justice (DOJ) is recommended to provide legal clearance for XRP-based transactions, and the Federal Reserve and Office of the Comptroller of the Currency (OCC) are urged to mandate direct integration of XRP into financial policy.

This proposal emerges amid evolving regulatory clarity for Ripple’s XRP. A previous court ruling determined that XRP is not considered a security in secondary market transactions.

In summary, the SEC’s recent publication indicates a strategic consideration of XRP as a potential replacement for the SWIFT system, aiming to enhance efficiency and reduce costs in government payment infrastructures.