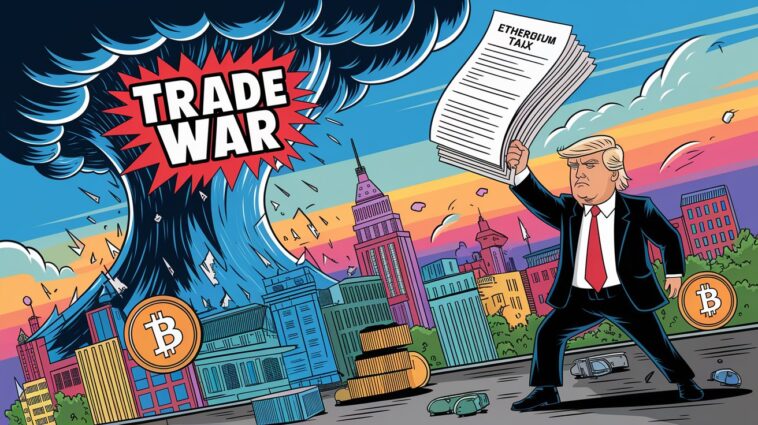

The crypto market is bracing for turbulence as U.S. President Donald Trump’s trade war policies resurface. With new tariffs set to take effect on April 2, analysts fear potential ripple effects across digital assets.

Why Crypto Investors Are Worried

The upcoming tariffs target key imports from China, raising concerns about global economic instability. Historically, uncertainty in traditional markets has impacted crypto prices, as investors move toward safer assets. Some experts warn that increased trade tensions could push institutional players away from volatile digital currencies.

Past Trade Wars and Crypto’s Response

During Trump’s presidency, similar tariffs triggered market shocks. While Bitcoin (BTC) initially benefited as a hedge against economic uncertainty, prolonged tensions led to fluctuating investor sentiment. The question now is whether crypto will react the same way or if the market has matured enough to weather the storm.

What’s Next?

As the April 2 deadline looms, traders are watching for Federal Reserve responses, global economic shifts, and institutional movements in crypto. If uncertainty spikes, we could see more volatility across major digital assets.