The SEC argues that almost all cryptocurrency sales, including those with limited buyer information, should be viewed as securities transactions, as buyers may expect value growth. Binance contends these claims lack legal basis and is pushing for dismissal of the case.

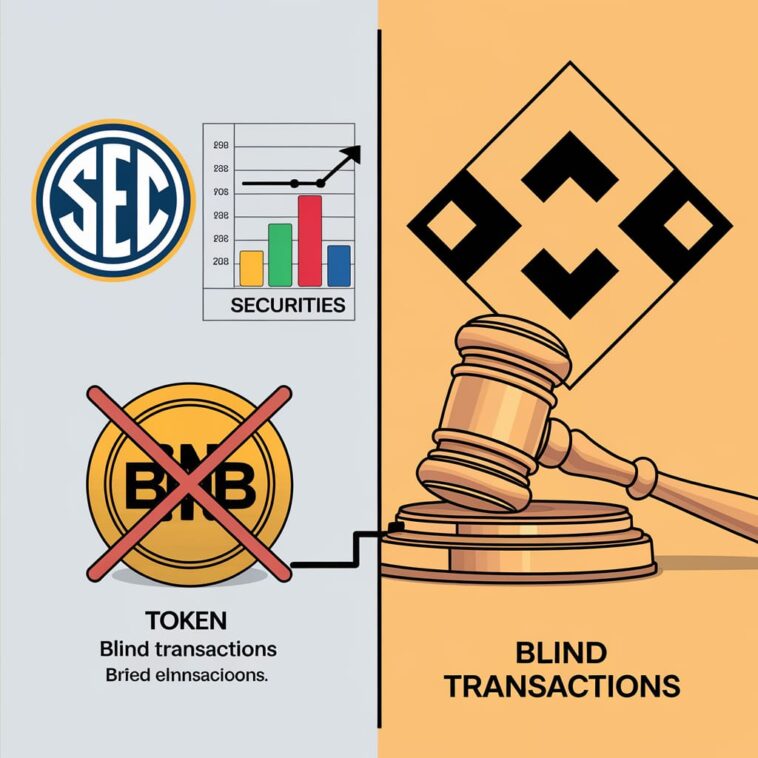

Defining Blind Transactions

The SEC focuses on “blind transactions,” where buyers on Binance didn’t realize they were purchasing BNB from Binance Holdings. Unlike the clear initial sale of BNB, these sales lack transparency. Blind transactions are common in the crypto world due to complex smart contracts and wallet restrictions.*

Ripple’s XRP Case Similarities

The SEC’s claims against Binance echo its accusations against Ripple regarding XRP sales. In a July 2023 ruling, Judge Analisa Torres stated that some XRP sales were legitimate because buyers couldn’t know whether their money went to Ripple or another seller.

Binance’s Ongoing Legal Struggles

These recent developments are part of the ongoing legal battle that started when the SEC sued Binance in June 2023. Binance’s founder, Changpeng Zhao (CZ), recently completed a four-month prison sentence after pleading guilty to violating U.S. Anti-Money Laundering laws.