Are Bitcoin Miners Nearing Capitulation?

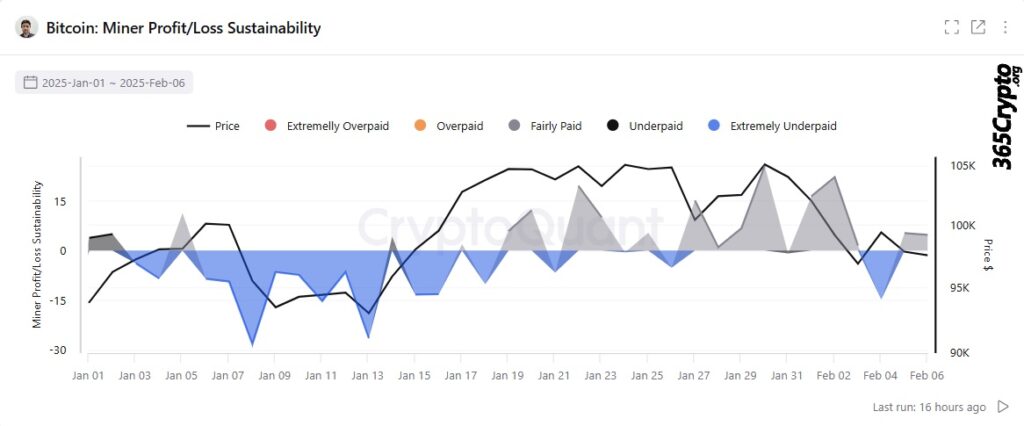

Bitcoin miners are currently facing significant financial pressure, as their profit/loss sustainability has entered the “extremely underpaid” zone. This raises concerns about potential miner capitulation.

Bitcoin has dropped 11.28% from its all-time high (ATH), negatively impacting miners’ profitability. With declining returns and increasing mining costs, the risk of capitulation looms large.

The Impact of Bitcoin’s Decline on Miners

Since reaching a new ATH of $109,000 nearly three weeks ago, Bitcoin (BTC) has fallen by approximately 11.28%. This decline has not only affected short-term holders but also placed substantial strain on miners. The latest price dip has made it increasingly difficult for miners to remain profitable.

CryptoQuant analyst Frost has pointed out that miners are currently operating under extreme financial stress, increasing the likelihood of capitulation.

Miner Profitability at Risk

Data from CryptoQuant reveals that Bitcoin miners’ profit/loss sustainability has reached an extremely underpaid zone. This situation has been exacerbated by the April 2024 halving, which led to greater mining difficulty. Despite these challenges, Bitcoin’s hash rate has continued to rise, reflecting heightened competition among miners.

With Bitcoin’s price continuing to decline, miners’ profitability has shrunk. Meanwhile, realized mining costs remain relatively high compared to the last difficulty bottom. These unfavorable market conditions suggest that some miners may soon be forced to capitulate.

Historically, when miners experience negative profitability, it often leads to a mid-term positive price reaction. Miners typically respond by selling Bitcoin to cover their operational expenses, further increasing sell pressure in the market.

Signs of Miner Capitulation

Recent data indicates that miner-to-exchange flows have surged to record levels, confirming that miners are selling their BTC holdings in large quantities. This trend is evident in the miners’ netflow total, which turned positive after being negative for five consecutive days. The shift suggests that more miners are moving their Bitcoin to exchanges for liquidation.

With operational challenges mounting, some miners may be forced into temporary capitulation. However, in past market cycles, such scenarios have created accumulation opportunities for investors looking to re-enter the market.

Will Miners Capitulate?

Given the declining profitability, assessing whether miner capitulation is imminent remains crucial. The Puell Multiple, a key metric for evaluating miner revenue, has stayed above 1 since January 13, dipping below this threshold only twice in early 2025. Despite fluctuations, this indicates that miner revenue remains relatively stable.

As long as the Puell Multiple stays above 1, the likelihood of widespread miner capitulation decreases. Instead, the current situation could represent a healthy market correction, potentially allowing strong miners and institutional investors to accumulate more BTC.

What’s Next?

According to AMBCrypto’s analysis, Bitcoin needs to recover in order to prevent miner capitulation. If BTC’s price continues to decline as it has over the past week, the risk of capitulation will increase.

For miners to maintain sustainability, Bitcoin must reclaim and hold above $100,000. Whether BTC can regain this critical level will determine the near-term fate of miners and overall market sentiment.

Source: ambcrypto