Bitcoin Post-Halving: Analyzing the Demand vs. Supply Dynamics

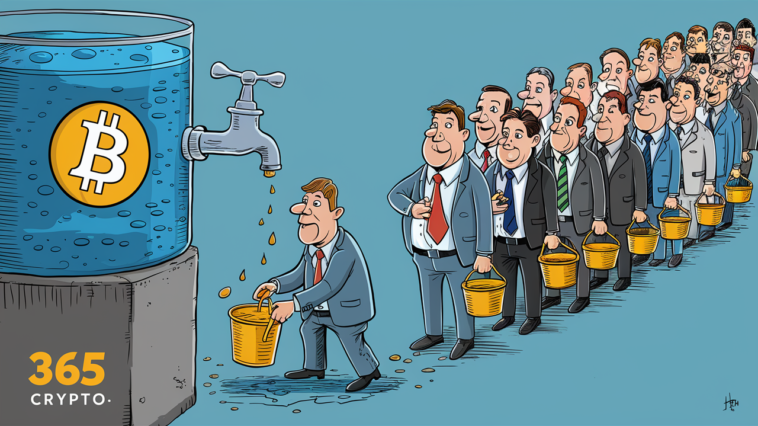

It’s been 307 days since Bitcoin’s latest halving event on April 20, 2024. With the mining reward cut in half, the market has been adjusting to a reduced BTC supply. However, the demand has significantly outpaced supply, creating an interesting dynamic for investors and institutions. Let’s break down the numbers and see how Bitcoin’s supply and demand have played out since the halving.

Bitcoin Supply and Demand Breakdown

Bitcoin Mined vs. Acquisitions

| Category | BTC Mined / Acquired |

|---|---|

| Total BTC Mined Since Halving | 137,700 BTC |

| MicroStrategy (MSTR) Acquisitions | 264,340 BTC |

| U.S. ETFs (Net Basis) | 331,857 BTC |

| Miner Public Companies Purchases | 45,478 BTC |

| Other Public Companies | 6,055 BTC |

| Short-Term Holder Buy-Pressure (excluding ETFs & MSTR) | 194,571 BTC |

| BTC Moved Off Exchanges (Adjusted for ETFs Swaps) | 70,071 BTC |

From the table, it’s clear that demand is massively outweighing new supply. Since the halving, only 137,700 BTC have been mined, yet over 449,491 BTC have been acquired by various entities. This means that demand is running at approximately 3.26x the mined supply.

Selling Pressure on Bitcoin

| Category | BTC Sold |

| Long-Term Holder Sell-Pressure | 312,120 BTC |

| General Miner Balance Sell-Pressure | 13,061 BTC |

Even with 312,120 BTC being sold by long-term holders and an additional 13,061 BTC in potential miner sales, the net effect shows a significant shortage of available Bitcoin on the market.

What This Means for Bitcoin’s Future

- Institutional Demand is Soaring – Companies like MicroStrategy and U.S. ETFs have been aggressively accumulating Bitcoin, with ETFs alone acquiring more than twice the number of new coins mined.

- Shortage is Real – With over 70,071 BTC moving off exchanges and demand outpacing supply by over three times, Bitcoin is experiencing a major supply crunch.

- Potential Price Impact – If this trend continues, with more Bitcoin being taken off the market than is being created, it could lead to significant upward price pressure.

Final Thoughts

The post-halving market structure highlights a growing imbalance between supply and demand. With institutional and retail investors continuing to accumulate at a rapid pace, the scarcity factor of Bitcoin is becoming more pronounced than ever. This could set the stage for continued price increases in the near future.

Will this demand trend persist? If so, Bitcoin’s next big bull run might just be getting started.