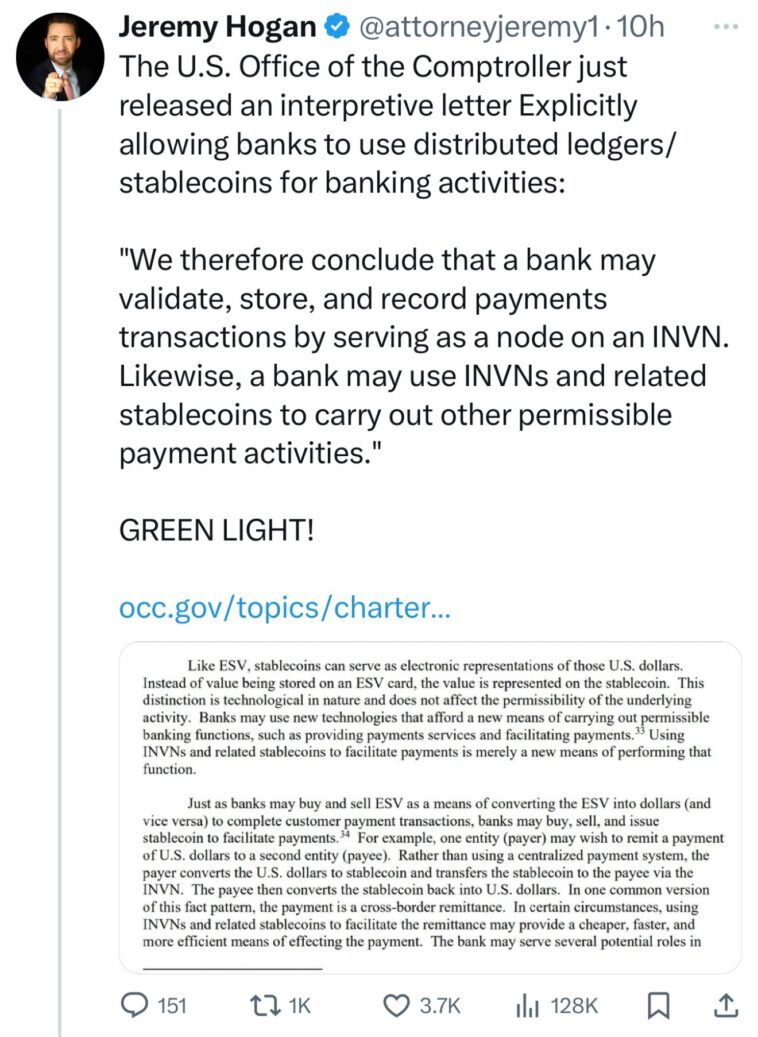

Jeremy Hogan, a prominent attorney known for his insights into cryptocurrency regulations, recently highlighted a significant development for the digital asset industry. On March 8, 2025, Hogan shared on social media that the U.S. Office of the Comptroller of the Currency (OCC) issued an interpretive letter explicitly permitting banks to utilize distributed ledger technologies and stablecoins for banking activities. He described this as giving banks the “green light” to integrate digital assets into their operations.

This move aligns with the broader trend of regulatory bodies providing clearer guidelines on the use of digital assets within traditional financial systems. The OCC’s guidance is expected to encourage banks to explore and adopt blockchain technologies and stablecoins, potentially leading to more efficient payment systems and financial services.

Industry leaders have welcomed this development. Jeremy Allaire, CEO of Circle—the issuer of the USDC stablecoin—noted that such regulatory clarity could allow banks to trade cryptocurrencies, offer crypto investments to clients, and hold digital assets in their portfolios. He anticipates that these changes will promote wider adoption of digital assets and foster innovation within the financial sector.

The OCC’s interpretive letter represents a pivotal step toward integrating digital assets into mainstream banking, signaling a shift in how traditional financial institutions may operate in the evolving digital economy.