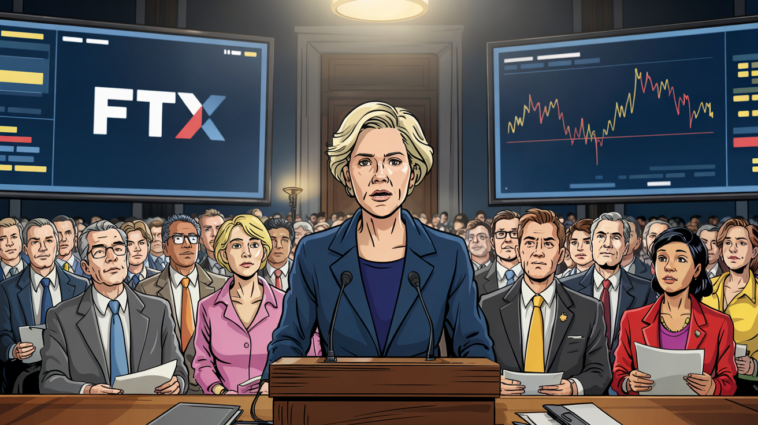

During a Senate Banking Committee hearing on March 27, Senator Elizabeth Warren scrutinized Paul Atkins, President Donald Trump’s nominee for Chair of the U.S. Securities and Exchange Commission (SEC), regarding his past associations with the cryptocurrency industry and potential conflicts of interest.

Concerns Over Past Judgment

Senator Warren highlighted Atkins’ tenure as an SEC commissioner from 2002 to 2008, criticizing his role during the 2008 financial crisis and questioning his judgment. She expressed apprehension about his leadership at Patomak Global Partners, a consulting firm that advised the now-defunct crypto exchange FTX.

Call for Transparency

The Senator urged Atkins to disclose the prospective buyers of Patomak Global Partners, emphasizing the need for transparency to avoid potential conflicts of interest. Atkins indicated his intention to sell the firm if confirmed but did not provide specific details about potential buyers.

Divergent Views Within the Committee

While Senator Warren focused on potential conflicts related to digital assets, other committee members, such as Chairman Tim Scott, expressed support for Atkins, citing the need for regulatory clarity in the digital asset space. Atkins himself emphasized the importance of establishing a coherent regulatory framework for digital assets.