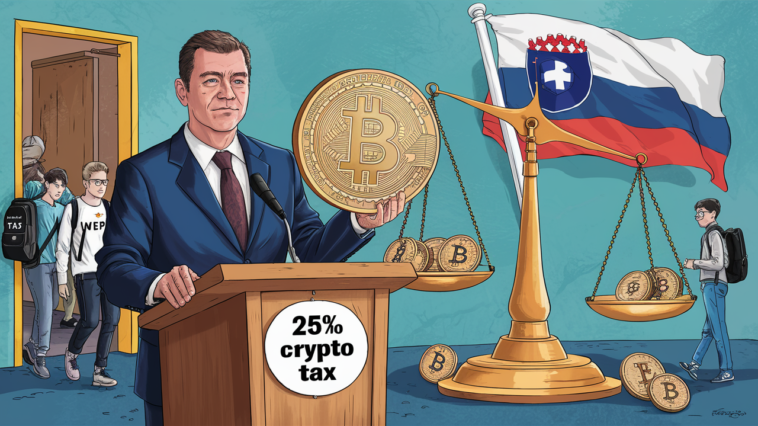

Finance Ministry proposes tax crackdown

Slovenia’s government is floating a 25% tax on crypto profits. If passed, it would hit traders every time they cash out or pay for stuff with crypto. But swapping one coin for another? That’s still tax-free.

What counts, what doesn’t

Under the plan, crypto-to-fiat conversions and payments would be taxed. But crypto-to-crypto swaps or moving funds between your own wallets would stay untaxed. The tax base? Profit made = selling price minus what you paid.

Keep your receipts

Traders will need to keep detailed records. All transactions must be reported in yearly tax returns. The ministry says this lines up with Slovenia’s existing tax laws.

Not everyone’s a fan

Finance Minister Klemen Boštjančič says it’s odd crypto isn’t already taxed. But not everyone agrees. Lawmaker Jernej Vrtovec thinks the tax will crush the country’s crypto scene. “We’re about to miss the train again,” he warned.

Past efforts and future fears

Slovenia tried smaller crypto taxes before, like a 10% fee on payments in 2023. But big proposals often stall. This one’s up for public comment until May 5. If passed, it kicks in on Jan. 1, 2026.

The crypto scene in Slovenia

Right now, crypto profits are tax-free—unless you’re running a business. Even then, it depends if you’re mining or staking. But with 98,000 users projected in 2025, regulators seem ready to cash in.

Fiat: Government-issued money like the euro or dollar.

Crypto-to-fiat: Exchanging cryptocurrency for fiat currency.

Staking: Locking up crypto to help run a blockchain network and earn rewards.